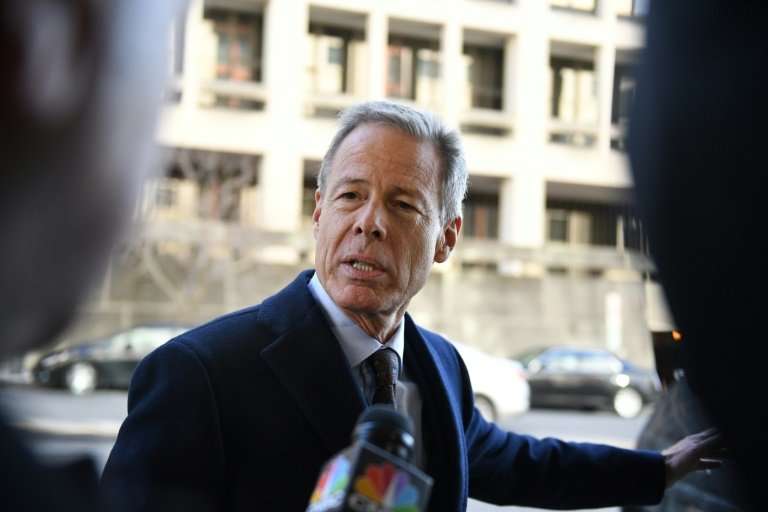

Time Warner CEO Jeff Bewkes defends the media-entertainment giant's proposed merger with ATT, which the government wants to block on anti-trust grounds

Time Warner chief Jeff Bewkes testified Wednesday that the media-entertainment giant needs to merge with AT&T because of "tectonic changes" in the television industry which favor big internet firms.

Bewkes appeared in a federal court trial as a key witness defending the mega-merger in the face of a US government antitrust effort to block the tie-up on the grounds it would create an industry titan which is too powerful.

In two hours of testimony, Bewkes maintained that Time Warner is challenged by "two big tectonic changes" in the television sector, in delivering programming and in advertising.

He said traditional TV players are being overtaken by fast-growing direct-to-consumer video services like Netflix and Amazon, and that advertising dollars are shifting to online platforms like Google and Facebook which can deliver personalized, targeted messages which are more cost effective.

The US Justice Department is seeking to block the $85 billion merger of AT&T, one of the largest pay TV and telecom operators, which Time Warner, which includes CNN, Turner cable networks, Cartoon Network and the HBO premium channel.

Bewkes testified the internet "has allowed giant new competitors which offer television directly to consumers," a reference to Netflix and Amazon.

He said these kinds of services have an edge over players like Time Warner because they have more data on their consumers.

By contrast, he said, Time Warner operates as a "wholesaler" of programs to cable and satellite operators and knows very little about who is watching which programs.

AT&T meanwhile, has relationships with some 150 million US consumers through its DirecTV service and other operations.

"They know what people are watching," he said.

Bewkes's testimony was aimed at blunting the government argument that a powerful merged company would seek to raise prices for consumers and would end up pushing up TV subscription costs.

The government maintains that most Americans still watch traditional television through cable bundles, and presented an expert who claimed fees could rise by some $400 million a year if the merger goes ahead.

© 2018 AFP