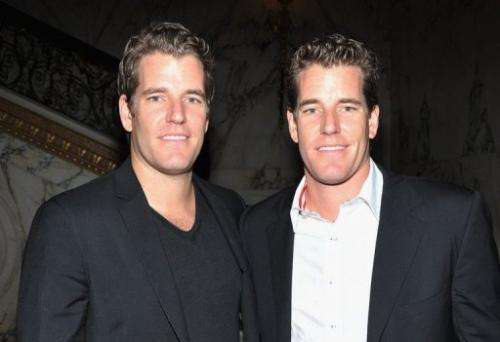

Tyler and Cameron Winklevoss are pictured during an event in New York, on October 3, 2012. The twin brothers, famous for their feud with Mark Zuckerberg over Facebook, told US regulators on Monday that they want to raise $20 million for an eponymous bitcoin trust.

The Winklevoss twin brothers, famous for their feud with Mark Zuckerberg over Facebook, told US regulators that they want to raise $20 million for an eponymous bitcoin trust.

Tyler and Cameron Winklevoss, through Math-Based Asset Services, on Monday filed a plan with the US Securities and Exchange Commission for an initial public offering for a Winklevoss Bitcoin Trust that will issue Winklevoss Bitcoin Shares.

"Shares are designed for investors seeking a cost-effective and convenient means to gain exposure to Bitcoins with minimal credit risk," the filing stated.

"As the sponsor and its management have no history of operating an investment vehicle like the Trust, their experience may be inadequate or unsuitable to manage the Trust," a risk section of the 74-page filing warned.

The trust planned an IPO of a million shares at a maximum price of $20.09, which the filing said was a fifth the average price of a single bitcoin at exchange sites Mt. Gox K.K., Bitstamp, and BTC-e on June 27.

The United States is studying the potential risk from online payment mechanisms like PayPal and Bitcoin, a top US Federal Reserve official told an international conference last month.

Some bankers have expressed worries that newer players in the online marketplace could have negative implications for the financial system.

A software engineer shows shows physical bitcoin, minted in Sandy, Utah, on April 26, 2013. Bitcoin is an experimental digital currency used over the Internet that is gaining in popularity worldwide.

"We have been talking... with banking organizations over the last year or two, trying more carefully to understand what the concerns are with these new payment mechanisms," Federal Reserve Vice Chair Janet Yellen said at the time.

She denied the widespread view that such players operate completely unregulated, saying the United States has a stronger regulatory environment than many are aware of, especially in the area of consumer protection.

"But that said, this is very much on our radar screen and we are carefully trying to identify where the risks are," Yellen added.

Last month, US authorities seized the accounts of one Bitcoin digital currency exchange operator, Mutum Sigillum LCC, claiming it was functioning as an "unlicensed money service business".

Bitcoins were launched in 2009 in the wake of the global financial crisis by an anonymous programmer who wanted to create a currency independent of any central bank or financial institution.

Some officials fear the virtual currency can be used by criminals or terrorists, or could be vulnerable to hackers.

The United States last month launched a money laundering probe against a digital currency operator, Costa Rica-based Liberty Reserve, which allegedly handled huge amounts of money outside the control of national governments.

© 2013 AFP