Annual wind report confirms tech advancements, improved performance, low wind prices

Wind energy pricing for land-based, utility-scale projects remains attractive to utility and commercial purchasers, according to an annual report released by the U.S. Department of Energy and prepared by the Lawrence Berkeley National Laboratory (Berkeley Lab). Prices offered by newly built wind projects in the United States are averaging around 2¢/kWh, driven lower by technology advancements and cost reductions.

"Wind energy prices—particularly in the central United States, and supported by federal tax incentives—are at all-time lows, with utilities and corporate buyers selecting wind as the low-cost option," said Berkeley Lab Senior Scientist Ryan Wiser.

Key findings from the U.S. Department of Energy's "Wind Technologies Market Report" include:

- Wind power additions continued at a rapid clip in 2016. Nationwide, wind power capacity additions equaled 8,203 MW in 2016, with $13 billion invested in new plants. Wind power constituted 27% of all U.S. generation capacity additions in 2016. In 2016, wind energy contributed 5.6% of the nation's electricity supply, more than 10% of total electricity generation in fourteen states, and 29% to 37% in three of those states (Iowa, South Dakota, and Kansas).

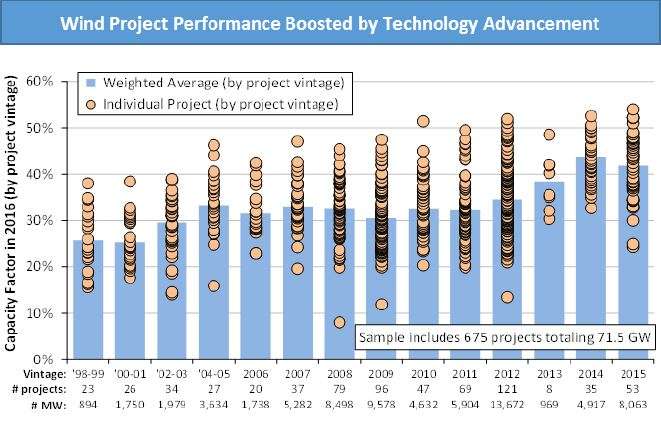

- Bigger turbines are enhancing wind project performance. The average generating capacity of newly installed wind turbines in the United States in 2016 was 2.15 MW, up 11% from the average over the previous 5 years. The average rotor diameter in 2016 was 108 meters, a 13% increase over the previous 5-year average, while the average hub height in 2016 was 83 meters, up 1% over the previous 5-year average. Moreover, turbines originally designed for lower wind speeds are now regularly deployed in higher wind speed sites, boosting project performance. Increased rotor diameters, in particular, have begun to dramatically increase wind project capacity factors. For example, the average 2016 capacity factor among projects built in 2014 and 2015 was 42.6%, compared to an average of 32.1% among projects built from 2004 to 2011 and 25.4% among projects built from 1998 to 2001.

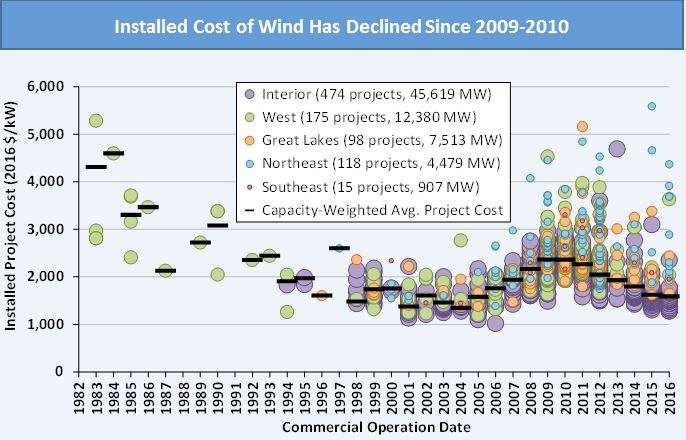

- Low wind turbine pricing continues to push down installed project costs. Wind turbine equipment prices have fallen from their highs in 2008, to $800-$1,100/kilowatt(kW), and these declines are pushing down project-level costs. The average installed cost of wind projects in 2016 was $1,590/kW, down $780/kW from the peak in 2009 and 2010.

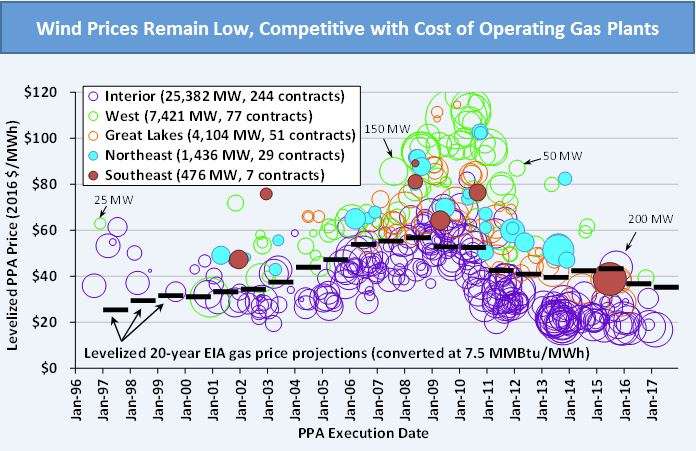

- Wind energy prices remain low. Lower installed project costs, along with improvements in capacity factors, are enabling aggressive wind power pricing. After topping out at nearly 7¢/kWh in 2009, the average levelized long-term price from wind power sales agreements has dropped to around 2¢/kWh—though this nationwide average is dominated by projects that hail from the lowest-priced region, in the central United States. Recently signed wind energy contracts compare favorably to projections of the fuel costs of gas-fired generation. These low prices have spurred demand for wind energy, both from traditional electric utilities and also from non-utility purchasers like corporations, universities, and municipalities.

- Manufacturing supply chains continued to adjust to swings in domestic demand for wind equipment. Wind sector employment reached a new high of more than 101,000 full-time workers at the end of 2016, and the profitability of turbine suppliers has generally rebounded over the last four years. For wind projects recently installed in the United States, domestically manufactured content is highest for nacelle assembly (>90%), towers (65-80%), and blades and hubs (50-70%). It is much lower (<20%) for most components internal to the turbine. Although there have been a number of manufacturing plant closures over the last decade, each of the three major turbine manufacturers serving the U.S. market—GE, Vestas, and Siemens—has one or more domestic manufacturing facilities in operation.

-

Installed cost of wind has declined since 2009-2010. Credit: Berkeley Lab -

Wind prices remain low, competitive with cost of operating gas plants. Credit: Berkeley Lab

More information: energy.gov/eere/wind/downloads … d-wind-market-report

Provided by Lawrence Berkeley National Laboratory