This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Research demonstrates need for student loan policies that encourage college enrollment

On February 28, the Supreme Court of the United States will hear arguments in two cases challenging the legality of the Biden administration's student loan debt relief program, which, if it prevailed, would cancel about $400 million in debt for about 16 million borrowers.

Soon after SCOTUS hears these arguments, many college admissions decisions will be released, with millions of high school students anxiously awaiting acceptance letters. Many of them hope that offers of scholarships and grants will accompany these letters, allowing them to finance their educations without debt similar to the obligations the Biden administration seeks to relieve for previous generations of borrowers.

Should the Biden administration succeed, debt relief would not apply to these students, only to prior borrowers. Given that fact, how do current and future high school students feel about borrowing for higher education? How do they decide whether and how much money to borrow and under what repayment plan?

These are difficult questions for an 18-year-old to answer, and according to Brent Evans, associate professor of public policy and higher education at Vanderbilt Peabody College of education and human development, the various complexities associated with student loans contribute to many students' aversion to borrowing for college.

"I study the causes of student loan aversion and how we can reduce aversion through improved policies and practices. When I consider the Biden administration's plan, it helps people who already have gone to college and have degrees, but it doesn't help or encourage people now who are trying to attend college, who will need to make these important educational and financial decisions in the coming months, and who may be reluctant to attend because they are averse to student loan debt," Evans said.

Evans argues financial aid policies should encourage students to attend college because a college degree leads to far greater earnings over one's lifetime, even if students must borrow money to finance their educations. He has conducted several studies—in collaboration with Angela Boatman at Boston College (formerly an assistant professor at Peabody) and Adela Soliz, assistant professor of public policy and higher education at Peabody—to identify students prone to loan aversion and reasons for their aversion, information that could help lead to better financial aid policies.

In one study, the researchers showed that between 20% and 40% of high school seniors were averse to student loans, women were less likely averse than men, and Hispanic students were more likely averse than white students. These findings suggest that policies to address loan aversion should target specific groups, with an understanding of their reasons for aversion.

In another study, the researchers found that the way financial aid choices are framed and labeled has a considerable influence on high school and community college students' likelihood of borrowing money for college. Labeling a contract as a "loan" reduced the likelihood of these students accepting the loan by 8 to 11 percentage points, with even more reluctance among Black and Hispanic students. The researchers conclude that federal and state governments as well as higher education institutions need to be more attentive to language when offering and explaining financial aid packages because of its considerable influence on borrowing preferences and decisions.

Evans and Boatman collaborated on two other loan aversion studies, as well. In the first one, they found strong correlations between higher financial literacy and knowledge of federal student loans and reduced loan aversion, with about 30% to 50% reduction in loan aversion in some samples. Specifically, knowledge of income-based repayment plans was associated with reduced loan aversion.

These findings suggest that when students understand the types of loan repayment options available to them, they make more informed decisions about investing in higher education and are more willing to do so, knowing that, in the case of income-based repayment systems, the rate of repayment depends on their earnings, which reduces financial risk.

Absent of this knowledge, students may underinvest in higher education, depriving them of a lifetime of increased wealth and limiting human capital development to the long-term detriment of society. The researchers contend that federal and state policies should address financial and loan literacy knowledge gaps, so that students can make more informed and financially prudent decisions.

The researchers followed this study with another that tested whether providing specific information to students via a short video on federal student loans and the advantages of income-based repayment plans affected the borrowing attitudes and perceptions of high school seniors. They found that this knowledge reduced loan aversion among these students, with evidence suggesting that it improved college enrollment. Educating students on income-based repayment plans before they need to make decisions about borrowing for college is key.

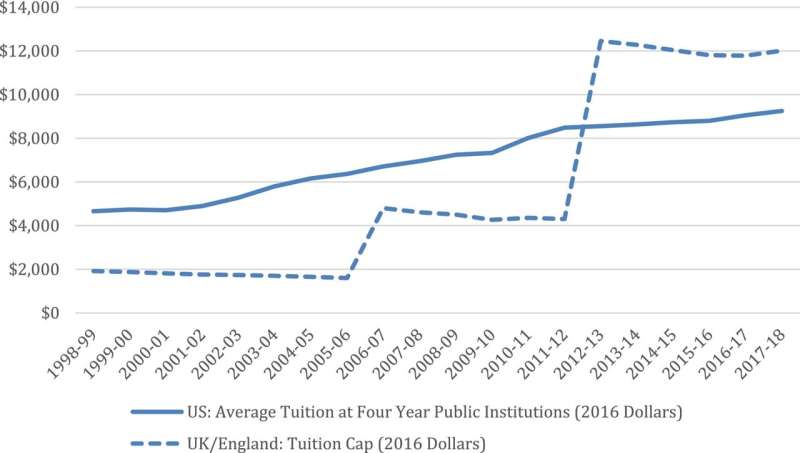

That said, Evans' latest loan aversion study, conducted in collaboration with Boatman and Claire Callender at the University College of London, and published in the European Journal of Education, revealed that American students are more loan averse and hesitant to attend college than their English peers because the U.S. loan system is more complicated and American students are more familiar with the traditional mortgage-style repayment system. England's borrowing process is simplified, and an income-based repayment system is the norm.

The Biden administration's student loan debt relief program does not address the policy needs demonstrated in Evans' research, and this next generation of college students cannot expect a future president to forgive their debt by executive fiat or a future SCOTUS to rule in favor of such a plan. Nor can they expect a tuition-free education policy any time soon. According to Evans, they need policies that empower their decisions about the best loan options available to them, reduce their loan aversion, and encourage them to invest in their educations.

More information: Angela Boatman et al, Comparing high school students' attitudes towards borrowing for higher education in England and the United States: Who are the most loan averse?, European Journal of Education (2022). DOI: 10.1111/ejed.12499

Provided by Vanderbilt University