This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Online grocery baskets less varied than in-store carts

Online grocery carts tend to include less variety and fewer fruits and vegetables than those in a trip to a brick-and-mortar supermarket—but online shoppers are less susceptible to unhealthy impulse buys, a new Cornell study has found.

In an analysis of nearly 2 million shopping trips, the researchers—doctoral student Sai Chand Chintala; Jura Liaukonyte, the Dake Family Associate Professor in the Dyson School of Applied Economics and Management, in the SC Johnson College of Business; and Nathan Yang, assistant professor in Dyson—found that within a given household, Instacart baskets are more similar to each other from week to week than in-store carts, with more than twice as many overlapping items between successive trips to the same retailer.

Nutritionally, however, the difference in the baskets can be viewed as a wash: Instacart baskets had 13% fewer fresh vegetables but up to 7% fewer impulse purchases such as candy, baked goods and chips.

These systematic shopping pattern differences can have implications for consumers as well as retailers.

"This affects a lot of things—how brands are competing, how grocery markets are competing," Liaukonyte said. The paper, "Browsing the Aisles or Browsing the App? How Online Grocery Shopping is Changing What We Buy," published in Marketing Science.

According to digital consulting firm Mercatus, around 54% of U.S. households placed an online grocery order in March 2021—a 328% increase from August 2019. And even as pandemic-era restrictions and behaviors have changed, some people have found online shopping has gone from a necessity to a convenience.

"There's a new equilibrium," Liaukonyte said. "Online shopping penetration has increased significantly—while it is not as high as it was during the peak of COVID, it remains considerably higher than pre-pandemic levels."

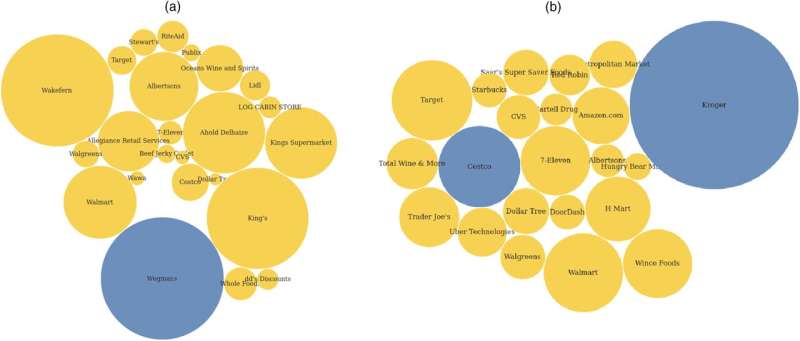

For this work, the authors analyzed data by Numerator, a market research company that uses a mobile app receipt uploads to analyze brick-and-mortar store purchases, and proprietary methods to access Instacart purchases from the same participants. The researchers' algorithm looked at three years' worth of grocery purchases from 4,388 participants to get a sense of their typical in-store and online carts.

The researchers discovered a few key differences:

- Online basket variety is around 10% lower compared to brick-and-mortar basket variety within the same household;

- Instacart trips are 27% more similar to each other than offline trips within the same household when comparing categories; and

- The number of overlapping items in Instacart baskets is more than double that of in-store carts when comparing items across successive trips to the same store.

One reason for the similarity and reduced variety in online baskets, the researchers suggest, is Instacart's "Buy it again" feature. This function simplifies the process for shoppers to initiate their new shopping baskets with items purchased during prior visits.

"We can't definitively say that this is the precise reason the online carts are more similar, as we cannot directly observe users utilizing this feature," Yang said. "However, it's an explanation that aligns with our observations and informal conversations with consumers about their shopping habits on Instacart."

Overall, Liaukonyte said, the findings of the paper indicate that there might be greater consumer loyalty and inertia when shopping online.

"If we don't pay attention," she said, "we might fall into an echo filter bubble of repeatedly buying the same items online. This seemingly simple online convenience could make us less sensitive to price changes and limit product discovery, enhancing the pricing power of existing brands."

Chintala added that the heightened brand loyalty and consumer inertia could make it difficult for new brands and products to enter the market.

"Industry reports suggest that if a product isn't in a person's cart by their first five or six online orders, it's very unlikely that the product will ever make it in," he said. "This highlights the importance for brands to advertise early on to ensure they are top-of-mind for consumers and make their way into their baskets."

Yang noted that traditional in-store promotional strategies, like product displays and samples for product discovery, don't translate seamlessly to online settings.

"Brands need to rethink their online product introduction methods, potentially leaning more on sponsored listings to ensure visibility," he said. "The long-term impact of these trends on online grocery shopping remains to be seen."

More information: Sai Chand Chintala et al, Browsing the Aisles or Browsing the App? How Online Grocery Shopping is Changing What We Buy, Marketing Science (2023). DOI: 10.1287/mksc.2022.0292

Journal information: Marketing Science

Provided by Cornell University