November 30, 2023 feature

This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

The first validation of the Lillo Mike Farmer Model on a large financial market dataset

Economics and physics are distinct fields of study, yet some researchers have been bridging the two together to tackle complex economics problems in innovative ways. This resulted in the establishment of an interdisciplinary research field, known as econophysics, which specializes in solving problems rooted in economics using physics theories and experimental methods.

Researchers at Kyoto University carried out an econophysics study aimed at studying financial market behavior using a statistical physics framework, known as the Lillo, Mike, and Farmer (LMF) model. Their paper, published in Physical Review Letters, outlines the first quantitative validation of a key prediction of this physics model, which the team used to analyze microscopic data containing fluctuations in the Tokyo Stock Exchange market spanning over a period of nine years.

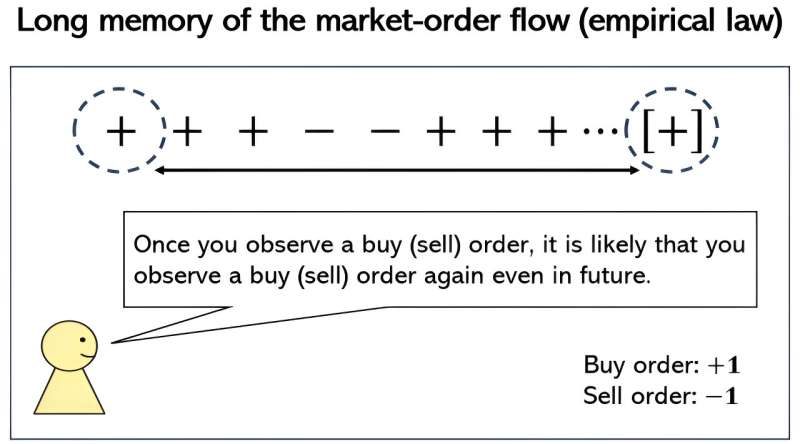

"If you observe the high-frequency financial data, you can find a slight predictability of the order signs regarding buy or sell market orders at a glance," Kiyoshi Kanazawa, one of the researchers who carried out the study, told Phys.org.

"Lillo, Mike, and Farmer hypothetically modeled this appealing character in 2005, but the empirical validation of their model was absent due to a lack of large, microscopic datasets. We decided to solve this long-standing problem in econophysics by analyzing large, microscopic data."

The LMF model is a simple statistical physics model that describes so-called order-splitting behavior. A key prediction of this model is that the order of signs representing buy or sell orders in the stock market is associated with the microscopic distribution of metaorders.

This hypothesis has been largely debated within the field of econophysics. So far, validating it was unfeasible, as it required large microscopic datasets representing financial market behavior over the course of several years and with high resolution.

"The first key aspect of our study is that we used a large, microscopic dataset of the Tokyo Stock Exchange," Kanazawa said. "Without such a unique dataset, it is challenging to validate the LMF model's hypothesis. The second key point for us was to remove the statistical bias due to the long-memory character of the market-order flow. While statistical estimation is challenging regarding long-memory processes, we did our best to remove such biases using computational statistical methods."

Kanazawa and his colleagues were the first to perform a quantitative test of the LMF model on a large microscopic financial market dataset. Notably, the results of their analyses were aligned with this model's predictions, thus highlighting its promise for tackling economic problems and studying the financial market's microstructure.

"Our work shows that the long memory in the market-order flows has microscopic information about the latent market demand, which might be used for designing new metrics for liquidity measurements," Kanazawa said.

"We showed that the quantitative power of statistical physics in clarifying financial market behavior with large, microscopic datasets. By analyzing this microscopic dataset further, we would now like to establish a unifying theory of financial market microstructure parallel to the statistical physics programs from microscopic dynamics."

More information: Yuki Sato et al, Inferring Microscopic Financial Information from the Long Memory in Market-Order Flow: A Quantitative Test of the Lillo-Mike-Farmer Model, Physical Review Letters (2023). DOI: 10.1103/PhysRevLett.131.197401.

Journal information: Physical Review Letters

© 2023 Science X Network