The physics of finance helps solve a century-old mystery

By unleashing the power of big data and statistical physics, researchers in Japan have developed a model that aids understanding of how and why financial Brownian motion arises. Researchers at Tokyo Institute of Technology (Tokyo Tech) have brought the worlds of physics and finance one step closer to each other.

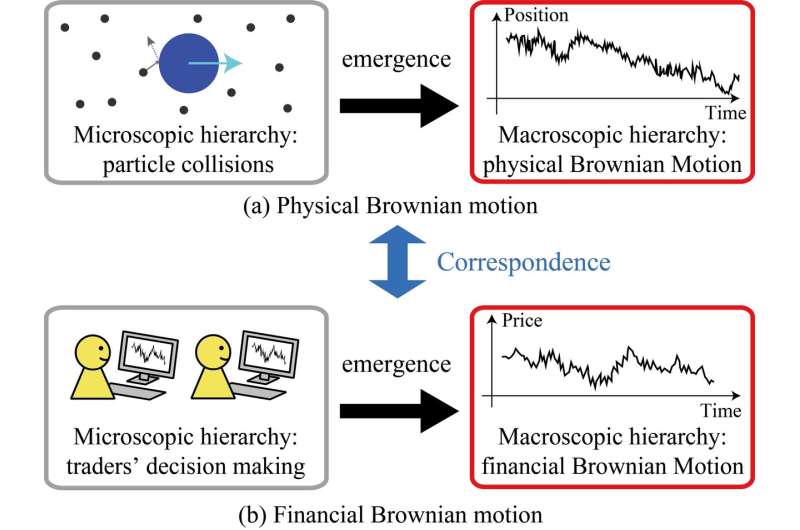

In a study published in Physical Review Letters, the team successfully demonstrated the close parallels between random movements of particles in a fluid (called physical Brownian motion) and price fluctuations in financial markets (known as financial Brownian motion).

In doing so, they revive the seminal work of French mathematician Louis Bachelier, who in 1900 was the first to describe the stochastic process, which later became known as Brownian motion in the context of financial modeling. Extraordinarily, Bachelier's findings were published five years before Albert Einstein published his first paper on physical Brownian motion.

"The mysterious similarities between physical and financial Brownian motion have intrigued scientists for over 100 years," the researchers say. "In our study, we have clarified how financial Brownian motion emerges from microscopic dynamics of the financial market based on direct observational data and theoretical analyses."

Looking at the U.S. dollar-Japanese yen market, the team used big data analysis to understand what is happening at the micro level, which boils down to the decision-making of individual foreign exchange traders.

Several studies conducted previously at Tokyo Tech by co-authors of the present study including Misako Takayasu laid the groundwork for exploring the emergence of financial Brownian motion in further detail.

The current work, led by Kiyoshi Kanazawa and overseen by Takayasu and others, benefited from a more comprehensive dataset that became available in July 2016. This dataset enabled a meticulous approach to tracking the trend-following behavior of individual traders. When examined collectively, this trend-following was found to be analogous to the concept of inertia in physics.

In addition, the researchers were able to scale up their model to show that their approach was consistent with larger (macroscopic) dynamics. Thus, they developed a framework that parallels the kinetic theory of molecules, which forms the theoretical basis of physical Brownian motion (see Figure 1.). They conclude that their model, rooted in standard physics, provides a solid foundation for understanding price fluctuations in stable financial markets.

They also aim to examine unstable markets vulnerable to external shocks—a hugely challenging area of research that will require better understanding of how traders react to different shocks, as well as how such behaviors could be reflected in a theoretical model.

"We strongly believe that financial markets are a good topic for hard science to tackle, thanks to recent technological breakthroughs such as big data analysis," they say.

More information: Kiyoshi Kanazawa et al, Derivation of the Boltzmann Equation for Financial Brownian Motion: Direct Observation of the Collective Motion of High-Frequency Traders, Physical Review Letters (2018). DOI: 10.1103/physrevlett.120.138301

Journal information: Physical Review Letters

Provided by Tokyo Institute of Technology