This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Study reveals the real tax rate paid by multinational corporations in 47 countries

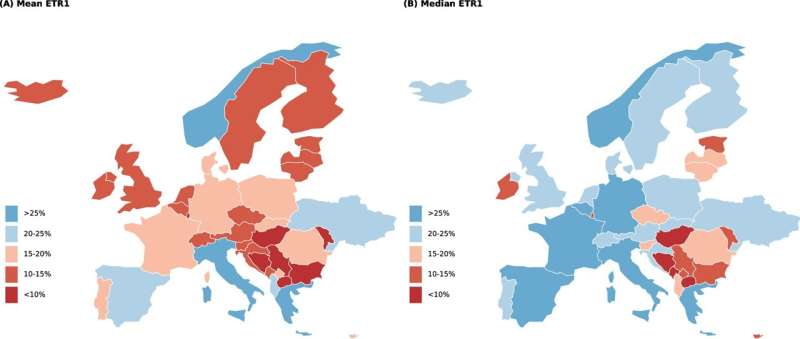

Despite a similar statutory tax rate for multinational corporations (MNCs) across many countries, the effective tax rate that MNCs actually pay differs greatly—as low as 1% of gross income in Luxembourg and as high as 67% in Norway. That's one conclusion of a study published in the open-access journal PLOS ONE by Javier Garcia-Bernardo of Utrecht University, the Netherlands, Petr Janský of Charles University, Czechia, and Thomas Tørsløv of Danmarks Nationalbank, Denmark.

The study comes on the heels of recent European Union legislation that aims to set a minimum effective tax rate across countries and redistribute MNC profits to address tax avoidance.

Tax avoidance by MNCs contributes to inequalities both between and within countries, and understanding the effective tax rates paid by MNCs in different countries is critical to minimizing these inequalities.

In the new study, researchers developed a new framework for computing the country-level effective tax rates for MNCs, using MNC income statement data that includes income across countries and taxes paid in different jurisdictions. They applied the framework to MNCs in 47 countries, mostly belonging to the European Union.

The study found that the amount of taxes accrued by MNCs varies considerably from country to country and reveals the extent of the differences between effective tax rates and statutory tax rates for many countries. At the extreme ends of the effective tax rate range were Luxembourg, with MNCs paying a rate of 1–8% of gross income in taxes, and Norway, with MNCs paying as much as 46–67%, despite the two countries having nearly identical statutory tax rates of 28% and 29%.

The authors conclude that statutory rates do not provide a great deal of information on the tax burden that MNCs actually face in many countries, and that better data is needed to obtain more reliable effective tax rate estimates and achieve more informed policy decisions.

The authors add, "We find that effective tax rates substantially differ across countries and from statutory rates for some countries. These findings should be of particular interest in the light of recent changes in the taxation of multinationals worldwide such as the 2021 agreement of more than 100 countries worldwide to a global minimum tax rate of 15%."

More information: Effective tax rates of multinational corporations: Country-level estimates, PLoS ONE (2023). DOI: 10.1371/journal.pone.0293552

Journal information: PLoS ONE

Provided by Public Library of Science