Probing Question: What is Bitcoin?

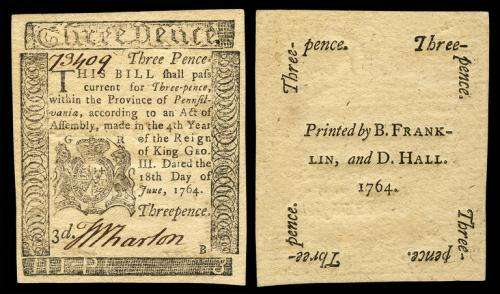

In 1729, when he was 23 years old, Benjamin Franklin authored a pamphlet titled "A Modest Inquiry into the Nature and Necessity of a Paper Currency." The revolutionary idea he advocated? Paper money printed and controlled by the Colonies. As a printer by trade, Franklin himself created some of the earliest American currency and fittingly, today Franklin's face is emblazoned on the largest denomination of U.S. currency in circulation—the one hundred-dollar bill, aka "a Benjamin."

The questions Franklin raised about the nature of money and its regulation in society are still relevant. It's easy to imagine that the famously prescient and witty statesman would have an opinion or two about the controversial emerging currencies of today's digital economy.

Could digital currency be poised to replace paper money?

The pursuit of an independent digital currency began in the early 1990s, explains John Jordan, clinical professor of supply chain and information systems at Penn State. Today's big contender, the Bitcoin, was introduced in 2008 by a person (or group of people) known only by the pseudonym Satoshi Nakamoto.

Bitcoin is a digital payment network that allows users to engage in direct transactions without the oversight of a banking organization or government. It's based on open source software, meaning the programming is published publicly, and any developer around the world can download, review or modify the source code.

Bitcoin is not technically a currency, though it functions like one, says Jordan. That's not just his opinion; it's also the conclusion of the IRS, which has decided to legally regard Bitcoin as property rather than currency.

Jordan compares Bitcoin to poker chips: "Poker chips can be used as a stand-in for money in certain situations, such as in a casino, and they can also be exchanged for money, but they aren't money; their value is dependent on the casino system itself."

Bitcoin users are represented anonymously on the peer-to-peer network, and each user has a digital "wallet" that holds their bitcoins. (The accepted practice is to capitalize the word when referring to the concept and community, and to use lower-case when referring to the system's tradable units.) When Bitcoin transactions between digital wallets occur, those transactions must be verified by other Bitcoin users and added to the shared, public ledger.

"Transactions are verified through the process of cryptography," explains Jordan, "essentially, very difficult mathematical algorithms solvable only with powerful computing systems. That's what keeps the system secure and the ledger complete."

This process of verifying transactions and adding them to the network ledger is called "mining," and the activity of mining is also what creates more bitcoin. "Essentially, I can create more bitcoin by doing the work of the Bitcoin community—processing transactions," Jordan says. The combined computing power of these peer-to-peer transactions is not just fast, he adds; it is a great deal faster than the world's fastest supercomputer.

If you find any of this mind-boggling to follow, you're not alone; its inherent complexity and technical jargon have given rise to countless "Bitcoin for dummies" articles, television drama plots, and even stand-up comedy skits. Some university campuses, including Penn State, now even offer active Bitcoin clubs.

But let's get down to dollars and cents: what about Bitcoin's exchange rate? Says Jordan, "As computers gain more power and the math algorithms are solved more quickly, the system adjusts by making problems more difficult to solve—to control how much Bitcoin is created. Consequently, Bitcoin's exchange rate with the dollar fluctuates and can be tracked in real time online."

All bitcoins in existence were originally created through mining, but today, users without the computational power to mine can purchase bitcoins on online exchanges and even at some special ATMs.

One of the primary advantages of Bitcoin, Jordan adds, is its lack of oversight by a government of financial organization. Unlike traditional payment methods like credit cards or money orders, transaction fees on the Bitcoin network are often nonexistent—or, at least, much lower.

"In concept, this is great news for small business owners," says Jordan. "In a low-margin business, those three percent charges on credit card transactions can really add up."

And Bitcoin can provide a huge advantage for foreign workers sending money home to families still in their home countries. "In this way, it's really an artifact of globalization," says Jordan. "Billions of dollars in remittances are transferred every year, and when doing it by Bitcoin, no money is lost to fees and service charges."

Beyond the potential savings in transfer fees, many people see an ideological advantage to the anonymity of the Bitcoin system and its existence outside of governmental oversight.

"A lot of people think the government really doesn't need to know what we're doing," says Jordan. Unfortunately, the anonymity of crypto-currencies perfectly serves the needs of the so-called 'dark net,' the online trade in drugs and other illegal goods. In 2013, FBI agents busted Silk Road, the web's biggest black market in drugs, and seized more than $28 million worth in bitcoins.

"Since it's a user's private key that performs a transaction, and the person behind the key is invisible, Bitcoin is an attractive choice for illicit transactions," notes Jordan. Regardless of its advantages for less nefarious business activities, Jordan is skeptical that Bitcoin will grow enough in popularity to gain widespread acceptance.

"Bitcoin is a really clever system, and it's useful in many ways," he says, "but it's still too volatile and it's impossible to imagine it existing outside of a computational environment."

That's one of its potential downfalls. "It's good at what it does, but it's early and the system was not designed to scale," Jordan says. "Interestingly, economists speculate that, although Bitcoin may ultimately fail as money, it could succeed as something else—like a method for documenting chain of custody. For the time being, Bitcoin remains viable only in selected scenarios. While it may ultimately decline in popularity or disappear completely, other cryptography-based systems will evolve to capitalize on the opportunity."

As Benjamin Franklin saw it, "Without continual growth and progress, such words as improvement, achievement, and success have no meaning."

Provided by Pennsylvania State University