This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Gender-diverse boardrooms reduce leaked deal information, research suggests

Research from Dr. Valeriya Vitkova, Senior Lecturer in Corporate Finance at Bayes Business School (formerly Cass), has revealed that merger and acquisition (M&A) deals involving target firms with greater boardroom gender diversity experience fewer leaks of pre-acquisition information than those with male-dominated leadership.

Deal leaks occur through the sharing of insider information prior to any announcement of a bid—often resulting in frenzied trading activity of both acquirer and target company shares—with the intention of capitalizing on higher bid premiums. They are often seen in a negative light, as they are associated with market abuse and misconduct, but they are also often a tactic used by target firms to attract rival interest, higher purchase prices, and quicker transactions with less due diligence.

The research, sponsored by SS&C Intralinks, is the first to show the impact of gender diversity on the likelihood of deal leaks and builds on Dr. Vitkova's previous work around the topic, showing female-led companies achieved higher rates of deal completion than those led by men during the COVID-19 pandemic.

Key findings include:

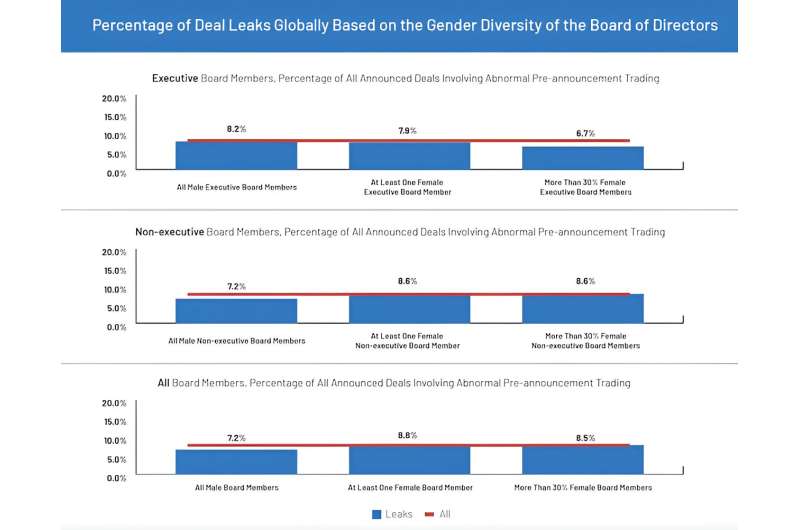

- When a target firm has a critical mass of at least 30 percent representation of female executive board members, deal leak incidence is reduced by nearly two percentage points from 8.6% with to 6.7% without.

- For target firms with 30 percent female executive and non-executive directorship, this is even lower at just 3.2%.

- Completion rates for leaked deals are significantly lower for targets with higher gender diversity in the boardroom—reduced from 84% down to 33%. This could be due to evidence that women tend to be more risk-averse and less overconfident than men, which can improve a board of directors' monitoring function and make it less likely to accept 'leaked' bids.

- Deal premiums are also higher in leaked deals at 58% with greater boardroom gender diversity than 53% without. The extra scrutiny of leaked deals, as seen in lower completion rates, leads to higher premiums being paid out to secure target firms.

The research used a sample of 12,747 transactions announced since 1 January 2009, obtained from Refinitiv's SDC Platinum database.

Dr. Vitkova said the study reinforced the benefits of boardroom gender diversity in dealmaking and furthers the case for greater female representation at the board level.

"Our analysis adds to a growing body of literature that examines whether corporate outcomes are positively influenced by the presence of greater diversity in leadership," she said.

"Previous research suggests women are more stakeholder-oriented and cautious than men, while boardroom diversity adds to the creative and innovative capabilities of a company. It is also commonly reported that the likelihood of misconduct is lower with a higher proportion of female board members."

"In the context of M&A, deal leaks are not uncommon and certainly not always intentional, but their presence undermines trust and market credibility."

Commenting on how both parties in a deal can better protect themselves from the threat of leaked information, which can alert outside parties and inflate the price an acquirer has to pay, Dr. Vitkova said better care and compliance are required at the board level.

"The management of M&A leaks starts by setting the tone at the top, right from the senior leadership team," she added.

"Greater gender diversity in senior leadership positions can be one step towards achieving this, but other measures can also be put in place. These include more diligence in the drafting of non-disclosure agreements (NDAs) and other contractual agreements between target, acquirer, and third parties."

"Adopting penalty clauses, imposing sanctions on advisor fees, and adding lower purchase price clauses into transaction engagement terms can also be used as leak deterrents."

Provided by City University London