This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Pandemic altered predictability of stock market, according to social media data

The stock market is known for its unpredictable nature. But how do investors react when an external event further throws it into chaos?

"Disasters are rare, and the COVID-19 pandemic brought a new wave of uncertainty to the stock market," said Michael Lash, assistant professor of business at the University of Kansas. "But social media allows us to now gather a vast amount of data to examine investor sentiment."

That collision of opportunities led to his new article, titled "Impact of the COVID-19 Pandemic on the Stock Market and Investor Online Word of Mouth" and published in Decision Support Systems. It explores the predictability of financial markets before, during and after the pandemic using social media data. It appears in Decision Support Systems.

Co-written with KU assistant professors of business Shaobo Li and Karthik Srinivasan and Towson University's Xiaorui Zhu, the article examines how normally predictive investor sentiment based on social media word-of-mouth (WoM) became unreliable during the peak-COVID and recovery periods. However, it remained stable during the pre-COVID period.

"When market conditions are normal and functioning as you might expect, there's a consistency you can observe," Lash said. "It's a steady signal. But when the pandemic was becoming a thing, the signals were moving all over the place."

Simply put, people didn't know where to look or what to trust.

"Suddenly, certain market indicators that folks typically rely on—like economic indicators and things like this—were no longer reliable," he said. "Everything went haywire. Nobody knew what to pay attention to. And that's what made the problem so difficult and the future so uncertain."

The researchers' findings suggest that investors who primarily trade on sentiment may wish to leverage machine learning techniques to identify latent topic information, subsequently applying such information when making trading decisions.

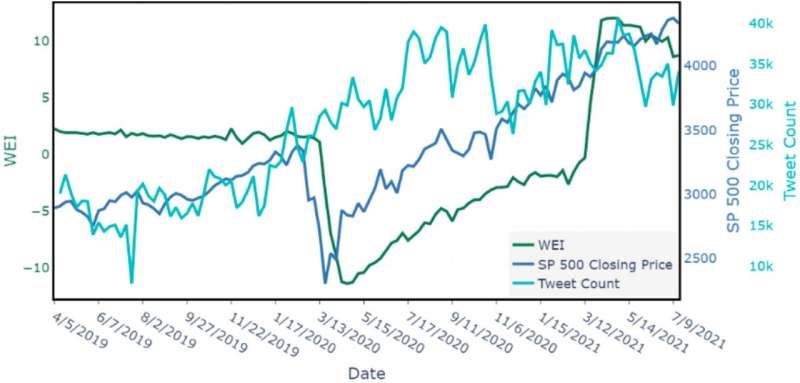

Lash and his team collected more than 24 million stock-related tweets from Twitter (now X) across these three periods and employed text-mining methods for feature engineering. They concentrated on two channels of WoM information: aggregate sentiments and disaggregated topics representing investors' overall opinions regarding the stock market.

"One thing we weren't anticipating is that as the pandemic ramped up and really took hold, we ended up seeing a lot more chatter surrounding the stock market," he said.

"The number of tweets about the stock market before the pandemic versus during it was around 1.7 times the number. Other media sources have reported that there were a lot more retail investors entering into the market who began trading during this time, and these tweets could be due to the stay-at-home effect."

Another unanticipated finding involved the increase in tweets that were specifically putting out daily stock rankings.

"We speculated this was in response to the drastic ramp-up of the number of retail investors entering the stock market," he said. "And we speculated many of these new retail investors might be paying attention to such advertisements, saying, 'Here are the top trending stocks. Here are the stocks with the largest returns over the last day, week, month.'"

Lash's previous research about the pandemic was in his 2023 paper "Predicting mobility using limited data during early stages of a pandemic," which explored how health metrics drive consumers' risk perception and affect retail mobility. It appeared in the Journal of Business Research. An Iowa native, Lash started working at KU in 2019. His expertise includes business analytics, machine learning and predictive modeling.

The main takeaway of his latest piece is clear: Don't do business as usual if there's a disaster.

"During disasters, folks who trade and institutions that trade are going to drastically need to recalibrate their models and their way of managing portfolios if they're going to aptly account for this developing catastrophe," Lash said.

"The details that mattered throughout COVID might not matter for whatever the next thing is. But you can use social media data to account for this, particularly if you focus on the topic of conversation that's unfolding as the event does."

More information: Xiaorui Zhu et al, Impact of the COVID-19 pandemic on the stock market and investor online word of mouth, Decision Support Systems (2023). DOI: 10.1016/j.dss.2023.114074

Journal information: Journal of Business Research

Provided by University of Kansas