This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Ethical shareholders advocate for environmental change even when it hits their wallets, study suggests

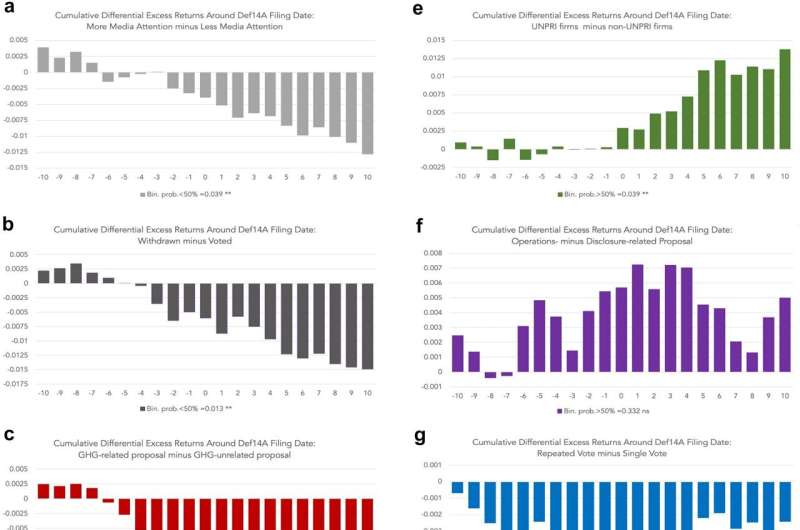

Ethical shareholders in United States firms—who are increasingly pushing for climate change—are willing to accept lower returns on their investments if it means companies change their practices to favor the environment, researchers suggest.

These are the findings of a new study co-authored by Paul A. Griffin, distinguished professor of in the Graduate School of Management at University of California, Davis. He and co-authors explored how shareholder activism on climate change affects both the firms' operations and investors' reactions. The paper was published this month in the Journal of Business Ethics.

"From an ethical perspective, our results highlight the growing importance of shareholder proposals on climate change, especially those related to how firms will perform in a low-carbon economy by addressing carbon risk, reducing emissions and increasing environmental performance," said Griffin.

Further, these shareholders' activism on climate change, through proposals submitted for consideration at a firm's annual general meeting, can persuade firms to make often costly changes to their operations.

Researchers examined 944 shareholder proposals submitted to 343 U.S. firms on climate change issued from 2009 to 2022. Of those proposals, 400 qualified for inclusion in the firm's proxy statement, which then guaranteed their eligibility for a vote at the firm's annual general meeting.

Not all proposals get to a vote

Shareholder proposals must meet certain requirements to be accepted for a vote. Shareholders must, for example, have continuously held 1% of the firm's outstanding stock, or $2,000 in market value, for at least one calendar year.

Much like lawmakers who author legislation, few of those initial shareholder proposals actually pass the various levels of scrutiny, deadlines, and other regulatory criteria to reach the point where they can be voted upon at the firm's annual general meeting and considered for adoption. Some may pass only after having been submitted many times. Investors and the public learn of the proposals when they are accepted for a vote.

Climate-change proposals on the rise

Shareholder proposals targeting climate change have been on the rise in recent years. In 2022, when such proposals numbered 195—the highest ever—they had risen 4.3% over the previous year. In 2021, these proposals were up 43.5% year over year, researchers said.

While ethical investors are driving positive changes in environmental performance of companies nationwide, researchers additionally noted that not all climate-related proposals universally lead to more positive returns and higher firm value.

Investors responded negatively to costly proposals for climate change such as those that relate to emissions reduction, as well as proposals that target carbon-intensive industries, which include oil, gas and other high-emission firms, the research showed.

More information: Ivan Diaz-Rainey et al, Shareholder Activism on Climate Change: Evolution, Determinants, and Consequences, Journal of Business Ethics (2023). DOI: 10.1007/s10551-023-05486-x

Journal information: Journal of Business Ethics

Provided by UC Davis