This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

The dynamics of innovation efficiency and firm competition: Implications for product design and market diversity

The efficiency of a firm's innovation efforts enhances its technological edge over competitors. However, the impact of such an advantage on the firm's product design and its competitive position in the market has remained largely unexplored until now.

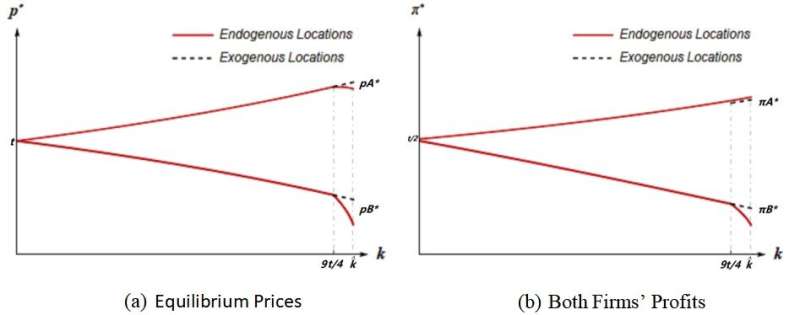

A study published in Journal of Economy and Technology has demonstrated for the first time the interactions between innovation efficiency and product design. This enables the leading firm to adopt the new predatory strategy to move toward its competitor, intensify price competition and prey on more market share. Remarkably, this approach includes implementing counter-intuitive price reductions while consistently increasing profits, showcasing the adaptability and effectiveness of this predatory strategy.

"Our finding shines a new light on the following research questions: How does innovation efficiency of a leading firm affect technology gap and product design in the market? How does this influence game results, including price competition and profits? How are consumer surplus and social welfare further influenced?" said Lin Liu, a co-author of the study and a professor at the School of Economics and Management Beihang University.

The study's findings align with observations in the high-tech sector, specifically in areas such as chips, electric vehicles, and smartphones. For instance, the evolution of technologies like the Bionic processor and ProMotion refresh rates has led to the iPhone adopting features similar to those of its competitors, including screen size and rounded corners. Similarly, as advancements were made in acceleration and top speed capabilities, Tesla, renowned for its electric SUVs, ventured into the crowded sedan market with the introduction of the Model X. Leveraging the advantages of Zen2 microarchitecture and 7nm technology, AMD collaborated with HP and Lenovo, both known for utilizing Intel chips in their laptop products, to create chips with identical specifications.

"These examples illustrate that firms with high innovation efficiency might raise their technology gap but reduce their product diversity compared to their competitors," said Liu. "Interestingly, the market prices of these firms are reported to have been reduced too, despite their profits increasing."

For instance, compared to the price of the older generation, iPhone 13 has reduced its price by 11.5% but its profit has increased by 43.6%. Similar changes in prices and profits are also observed in the cases of Tesla's Model X and AMD's chips. These analytical findings carry significant policy implications for social planners and industry regulators, particularly concerning technology gaps and product design. If there is a desire to uphold product diversity within the market, it becomes essential to monitor the innovation efficiency of leading firms. Allowing an excessively high technology gap between competitors could potentially have adverse consequences.

More information: Jue Liang et al, Innovation Efficiency and Firm Competition, Journal of Economy and Technology (2023). DOI: 10.1016/j.ject.2023.06.001

Provided by KeAi Communications Co.