This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Investors also suffer in unregulated competition for freely available resources, study finds

Without regulations for their use, the condition of freely accessible resources such as fish stocks, water or air can deteriorate dramatically. In economics, this is referred to as the "Tragedy of the Commons." In 2009, Elinor Ostrom became the first woman to win the Nobel Prize in Economics for her studies on this topic. Ostrom's question of how to prevent this "tragedy" is just as relevant today as it was some 20 years ago.

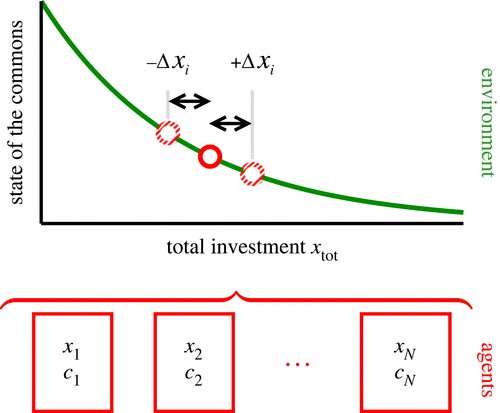

Game theory deals with situations in which a number of agents compete with each other, with each participant trying to maximize his or her own profit individually. One speaks of a "Nash equilibrium" if players cannot increase their returns further. The "Tragedy of the Commons" is a game theoretical scenario in which the actors do not compete directly, but indirectly: If someone takes a piece of a common pie, there will be less for everybody else.

Instead of investigating how to avoid the "Tragedy of the Commons," Claudius Gros from Goethe University's Institute for Theoretical Physics examined the resulting Nash equilibrium, with unexpected results: If a common good is divided more or less equally among N interested parties, then each receives a share of the order 1/N. However, the respective investment costs still need to be deducted.

Gros' calculations show that, in equilibrium, the actors increase their engagement until the resulting investment costs almost reach the value of the resources the individual investor can secure for her- or himself. Mathematically, the theoretical physicist was able to show that the final profit of the individual investor scales as 1/N².

The original expectation, that investors each receive a proportional share from the resource, remains correct, as Gros' research shows. However, this does not translate into an overall return of the same proportion, which is smaller by a power in the number of investors. Gros denotes the dramatic deterioration of the net profit as "catastrophic poverty," as it implies that unregulated competition drives the individual actor close to the profitability limit, viz to the subsistence level.

Similarly, Gros was able to show that catastrophic poverty can be avoided when the actors cooperate with each other. Cooperation leads to a net profit corresponding to the number of investors in simple power, the classical result.

The result of the investigations is therefore that the "Tragedy of the Commons" can cause substantially more damage than previously assumed. Uncontrolled access not only leads to a potentially excessive exploitation of the resource, a topic that has been the focus of many previous studies. In addition, investors suffer themselves when only maximizing their own profits.

Mathematically, Gros was able to show that technological progress intensifies this process and that either all, or the vast majority of participating investors are ultimately affected by catastrophic poverty. If anything, only a few investors—the oligarchs—stand to gain more.

The study is published in Royal Society Open Science.

More information: Claudius Gros, Generic catastrophic poverty when selfish investors exploit a degradable common resource, Royal Society Open Science (2023). DOI: 10.1098/rsos.221234

Journal information: Royal Society Open Science

Provided by Goethe University Frankfurt am Main