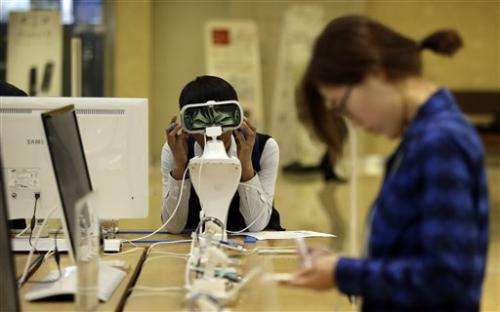

Samsung vows changes after mobile profit plunges

Samsung Electronics Co. admitted erring in its smartphone strategy and vowed Thursday to overhaul its handset lineup after profit from those devices tumbled last quarter to the lowest in more than three years.

The South Korean company, which climbed from smartphone laggard to top seller in the past three years, had prided itself on responding quickly to market demand and ability to tailor handsets to the needs of users and mobile carriers around the world.

But its rapid success with a product category pioneered by rival Apple Inc. is undergoing an equally stunning reversal. Earnings from Samsung's mobile phone business began declining this year, undermined by lukewarm sales of the Galaxy S5 smartphone and the competitive onslaught from cheaper local brands in China and India. Apple also eroded Samsung's leading market share in developed nations.

In a rare acknowledgement of a misstep, the company's head of investor relations told an earnings conference call that Samsung had lagged behind changing market conditions. The company's response "was not quick enough," said the executive, Robert Yi.

It plans a significant change in smartphone strategy for next year to seek more "efficiency," implying that the number of new handset models might be reduced. That will allow the company to better focus on each product and to purchase components at cheaper prices to save costs.

Unlike Apple's take it or leave it approach, Samsung boasted that it gave more choice to consumers, launching at least two flagship models per year and making smartphones in a variety of screen sizes and various features.

The drop in earnings from the mobile business battered the South Korea company's quarterly net profit, which tumbled 49 percent to 4.2 trillion won ($4 billion). That was the lowest since the first quarter of 2012, but above market expectations. Analysts polled by FactSet had predicted net income of 3.7 trillion won.

Operating income from its mobile business, which previously had contributed more than 60 percent of its entire earnings, fell to 1.75 trillion won ($1.66 billion) from 6.7 trillion won a year earlier.

Quarterly sales fell 20 percent to 47.4 trillion won while operating income shrank 60 percent to 4.1 trillion won.

Samsung warned earlier this month that its handset profit had declined despite a marginal increase in shipments. Analysts said the Galaxy S5 smartphone launched in April did not sell well while many consumers held off upgrading their phones, instead waiting for new iPhones.

"High-end smartphone sales result was somewhat weak," said Kim Hyun-joon, senior vice president at Samsung's mobile communications business. "We will fundamentally reform our product portfolio."

Samsung retained its leading position in the global smartphone market during the third quarter, but it was the only top five handset vendor to record a sales decline. Apple, Xiaomi, Lenovo and LG Electronics all posted more than 15 percent growth in their smartphone shipments, according to market research firm IDC.

Discover the latest in science, tech, and space with over 100,000 subscribers who rely on Phys.org for daily insights. Sign up for our free newsletter and get updates on breakthroughs, innovations, and research that matter—daily or weekly.

Samsung's shipments fell 8 percent to 78.1 million smartphones in the third quarter and its market share eroded to 24 percent from 33 percent a year earlier.

Samsung's rise to the world's top smartphone maker was largely thanks to its early bet on Google's Android operating system. But with other Android handset makers catching up in performance, features and design, Samsung is facing pressure to add an impressive and differentiating new feature to its phones.

One of its answers was the Galaxy Note Edge smartphone with a curved side screen that can display icons, news flashes or weather. But with a limited supply of curved displays, Edge smartphone production will remain small. It went on sale in Japan and South Korea this month.

The company gave little detail about how it would differentiate new smartphone's software or user experience. On the hardware front, Samsung said flexible displays and a metal case will help its new phones to stand out.

With a plunge in smartphone profit, Samsung is increasingly relying on semiconductors. For the first time since the third quarter of 2011, the semiconductor division reported a larger quarterly profit—2.3 trillion won—than the mobile communication division.

Samsung projected that its earnings would grow in the current October-December quarter, driven by the memory chip business. But it was uncertain whether its smartphone business would recover because it may have to increase marketing expenses to compete with rival handsets and to clear out inventory before the start of 2015.

The Galaxy Note 4 smartphone, which will compete with the big-screen iPhone 6 Plus, will go on sale in more countries during the final quarter of 2014, Samsung said. It is aimed at consumers who like smartphones as big as tablets.

Shares of Samsung Electronics rose 4 percent in Seoul. The result, though weak, was better than the direst forecasts and Samsung indicated it could increase dividends next year.

© 2014 The Associated Press. All rights reserved.