Visa discloses stake in Dorsey's company, Square

Shares in the mobile payment services company Square rose sharply Friday after Visa disclosed the details of its ownership stake in the company.

While Visa's stake amounts to about 1 percent of the company, and the stake was established at least 5 years ago, investors interpreted the announcement as a major endorsement of Square by Visa, the world's largest payment processing company.

According to a regulatory filing, Visa owns 4.2 million of Square's Class B shares. While Class B shares are not traded publicly, Visa could convert up to 3.5 million of its Class B shares to Class A, which would give Visa a 9.99 percent ownership of that class of shares. That conversion would amount to just 1 percent of Square's total outstanding shares, however.

Visa's calculation of a 9.99 percent ownership is based on the assumption that no other Square's Class B shareholders did a similar conversion before Visa did.

The disclosure, known by its regulatory filing name 13G, is how major investors disclose an existing stake in a company. Because Square only went public three months ago, this is the first time the public is getting details about Visa's ownership. Visa announced an investment in Square in 2011, but at the time did not disclose the terms of that transaction. Other companies have disclosed similar details about their existing ownerships of Square, including JPMorgan Chase.

Class B shares are not typically converted to Class A shares unless the owner is looking to sell the position, and Visa did not disclose any plans to do so. However, if Visa were to convert its Class B shares into Class A shares, it would make Visa the second-largest owner in Square behind the investment manager Capital Research & Management's 12.7 percent stake.

Visa has been working on payment services technology of its own including Visa payWave, which allows users to pass a card over a terminal to record a payment.

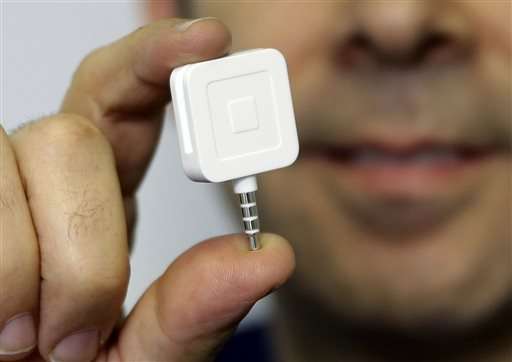

Square Inc., co-founded and run by Twitter Chief Executive Jack Dorsey, went public in November. The Square device facilitates credit card transactions by plugging into smartphones or tablets, allowing credit cards to be accepted almost anywhere.

Square shares rose 8 percent Friday to close at $9.30.

© 2016 The Associated Press. All rights reserved.