Icahn sues over Dell buyout bid

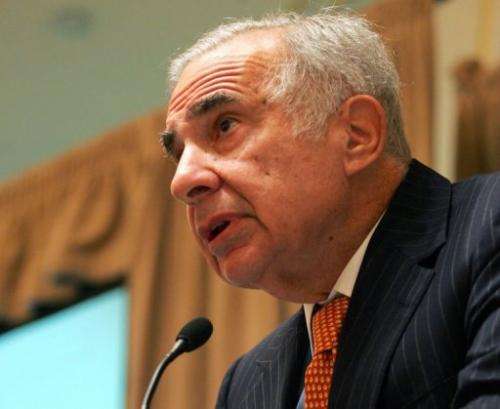

American investor Carl Icahn has filed a lawsuit aimed at blocking changes in timing and terms for shareholder voting Friday on a bid to take computer maker Dell private.

The suit filed in the state of Delaware by Icahn and affiliates urges the court to lay out a series of stumbling blocks to moves that would improve the chances of Michael Dell succeeding in his effort to take the company private.

The litigation seeks to prevent a change in the date by which Dell shares must have been purchased to qualify to vote and to bar those behind the buyout from voting shares bought after February 5 of this year.

The lawsuit also accuses the Dell board of directors of breaching its fiduciary duties.

A committee set up to consider a buyout of Texas-based Dell rejected a proposal intended to boost a go-private proposal, according to a letter released Wednesday.

The special committee, which has been weighing a $24.4 billion bid from a consortium led by company founder Dell to take it private, said in a letter to him and his partners that it "is not prepared to accept your proposal."

The letter did not elaborate on the decision.

Dell and his private-equity partner Silver Lake Partners on July 24 proposed bumping up the offer by 10 cents to $13.75 per share, but only if the special committee agreed to change the way votes are counted.

The proposal sought an approval process that would require a majority of shares voted, instead of a majority of all outstanding shares not affiliated with Michael Dell.

Dell postponed the vote two times earlier this month out of concerns of insufficient shareholder support, in part because shares held by parties that did not vote are to be counted as "no" votes under the current system.

The letter from the special committee said it was willing to change the date of the vote to allow shareholders more time to consider the amended $13.75 per share bid.

Alternatively, the special committee said it was willing to proceed with the existing $13.65 per share bid scheduled for August 2.

Dell, once the world's biggest personal-computer maker, has fallen behind rivals Lenovo and Hewlett-Packard and faces pressure because of slumping PC sales as consumers increasingly turn to tablets and smartphones.

A recent survey showed worldwide sales of personal computers fell for a fifth consecutive quarter in the April-June period.

© 2013 AFP