Credit card debt: Younger people borrow more heavily and repay more slowly, study finds

(Phys.org)—Younger Americans not only take on relatively more credit card debt than their elders, but they are also paying it off at a slower rate, according to a first-of-its-kind study.

The findings suggest that younger generations may continue to add credit card debt into their 70s, and die still owing money on their cards.

"If what we found continues to hold true, we may have more elderly people with substantial financial problems in the future," said Lucia Dunn, co-author of the study and professor of economics at Ohio State University.

"Our projections are that the typical credit card holder among younger Americans who keeps a balance will die still in debt to credit card companies."

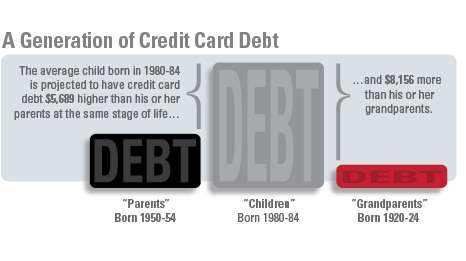

The results suggest that a person born between 1980 and 1984 has credit card debt substantially higher than debt held by the previous two generations: on average $5,689 higher than his or her "parents" (people born 1950-1954) at the same stage of life and $8,156 higher than his or her "grandparents" (people born 1920 to 1924).

But the study also did uncover some good news: Increasing the minimum monthly payment spurs borrowers to not only meet the minimum, but to pay off substantially more, possibly eliminating their debt years earlier.

Dunn conducted the research with Sarah Jiang of Capital One Financial in McLean, Va. Their results appear in the January 2013 issue of the journal Economic Inquiry.

This study is significant because it is the first to use data on not only how much people borrow on their credit card, but their complete payoff information as well.

"Most data sets available to researchers only contain one side of credit card behavior – borrowing. We have data on how they pay off credit cards as well, which gives us a more complete picture of their debt situation," Dunn said.

"This allows us to estimate more precisely when Americans will be able to pay off their credit card debts."

The data in the study comes from two large monthly surveys. The first is the Ohio Economic Survey, which was conducted from 1996 to 2002. This was the precursor to the second survey, the national-level Consumer Finance Monthly, which began in 2005 and is ongoing. It is conducted by Ohio State's Center for Human Resource Research.

The researchers combined the data to obtain information for 13 years, from 1997 to 2009. They examined respondents from 18 to 85 years of age, and had a final sample size of 32,542.

When the researchers analyzed data from the entire set of respondents at any one point in time, they found evidence of what is called the simple life-cycle hypothesis: Credit card debt increases at younger ages, peaks at middle ages and then tapers off at older ages.

But this is misleading because it doesn't take into account differences in how people who grew up at different times in history may approach credit card debt, Dunn said.

In order to correct for that, the researchers compared the credit card debt of 15 different birth cohorts – people who were born in the same five-year period. The first cohort was 1915 to 1919 and the last cohort studied was people born 1985 to 1989.

Using a statistical model, they were able to compare how people who were born in different time periods, but with similar characteristics – such as education, income and marital status, among many other factors – dealt with credit card debt.

That is how they concluded that young people born 1980 to 1984 had on average over $5,000 more in credit card debt than their parents at a similar point in their life and slightly more than $8,000 more when compared to their grandparents.

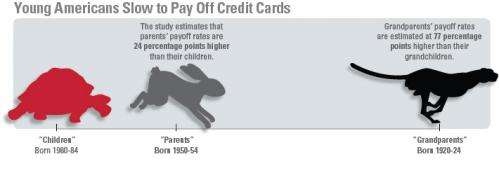

In addition, the results suggest younger people are paying off their debt more slowly, too. The study estimates that the children's payoff rate is 24 percentage points lower than their parents' and about 77 percentage points lower than their grandparents' rate.

Dunn said there are several reasons why younger generations have higher credit card debt.

"Credit is more readily available now, and there have been changes in interest rates and less stigma attached to having credit card debt, which may all make younger people today more willing to go into debt," she said.

With the payoff data available, the researchers were also able to find out how increasing the minimum payment on credit cards affected how much cardholders actually paid on their debt each month.

The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act led to lenders collecting at least the interest accrued each month as the minimum required payment. Minimum payments for many cardholders were raised again after the recession of 2007.

The good news in this study is that cardholders respond to higher minimum payments by paying well above what they have to. Findings showed that increasing the minimum payment by one percentage point increased the average payoff rate by 1.9 percentage points. That means increasing the minimum required payoff rate from 2 percent to 4 percent increases that average payoff rate by 3.8 percentage points.

The real-world effects could be huge. For example, making only the 2 percent minimum required payment each month on a balance of $1,000 at an interest rate of 19 percent will mean it takes eight years and four months to repay the balance in full.

However, holding other factors constant, if the actual monthly payment increases from 2 percent to 5.8 percent as a result of the new policy, it will take only one year and nine months to pay off the debt.

"Raising the minimum payoff rate can have a powerful effect on how people actually pay off their credit card debt, much more so than you might expect," Dunn said.

Dunn said an increase in the minimum payoff rate may give a psychological jolt to cardholders.

"They may see the increase in their minimum payment and start feeling uncertain about their future ability to pay off their debt," she said.

"That may encourage them to pay off even more than they have to, in order to bring their debt level down."

But even with this good news, Dunn said the results should concern all Americans.

"If our findings persist, we may be faced with a financial crisis among elderly people who can't pay off their credit cards."

More information: www.weai.org/EI

Provided by The Ohio State University