February 19, 2012 report

Study links ultrafast machine trading with risk of crash

(PhysOrg.com) -- In the United States, ultrafast trading in financial markets between 2006 and 2011 was the underlying factor for over 18,000 extreme price changes, according to a new study. Neil Johnson, a professor in the physics department of the University of Miami in Coral Gables, one of the authors of the study, thinks that a buildup of such "fractures" can destabilize the market. This study, “Financial Black Swans Driven by Ultrafast Machine Ecology” was submitted to arXiv earlier this month, suggesting the link between extreme-change fractures and market crashes.

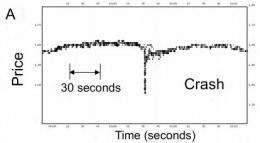

The authors looked at a set of what they call "18,520 ultrafast black swan events" that they uncovered in stock-price movements between 2006 and 2011. A case in point is what occurred on May 6, 2010, when it took just minutes for a spontaneous mix of interactions in cyberspace to generate the Flash Crash, first a plunge, in minutes, and soon after a recovery.

The speed in which the rises and falls occur might last no longer than half a second, unapparent to any human who is tracking prices. Johnson says if you blink you miss it. Flash events may happen in milliseconds and have nothing to do with a company’s real value.

To examine such incidences and their frequency the authors of the study waded through price logs from over 60 markets collected by Nanex, a Chicago company that sells streaming market data. The data revealed that the ultrafast fracture events were not infrequent but common, totaling 18,520 in the 2006 to 2010 time span. The authors looked for extreme changes in a stock price, which they defined as a change greater than 0.8 per cent, over timescales shorter than 1.5 seconds.

The speed in which ultrafast events happen is of concern as human oversight becomes impossible if trades are taking place faster than humans can react. Machine trading today carries computerized trading algorithms that make automated trades in milliseconds and make some experts uncomfortable, in the fear that out-of-control algorithms can cause a crash.

Following the May 2010 event, U.S. regulators, as a safety mechanism, upheld circuit breakers designed to stop trading if a stock price makes a sudden large move. Whether or not that is the best solution around, considering the speed in which today’s machine trading can occur, does not convince all market experts. At that level of resolution, one of the study authors said it was troublesome to even observe, leave alone regulate.

The authors suggest an early warning system for when the markets are becoming unstable. According to a Wired report, the authors would like to see an approach that might help steer automated markets by introducing “rogue algorithms when herd behaviors appear imminent.”

In a recent Q&A interview, Johnson said the “fracture” analogy to real materials is useful in assessing today’s financial markets. “Where we want to head to is the analogy of a trained aircraft engineer, who can pretty much look at the microscopic arrangement of small fractures in an aircraft and judge whether it is safe to continue flying that plane or not. To have this for markets would be an incredibly important step toward understanding, and managing, risk."

More information: Financial black swans driven by ultrafast machine ecology, by Neil Johnson, Guannan Zhao, Eric Hunsader, Jing Meng, Amith Ravindar, Spencer Carran, Brian Tivnan, arXiv:1202.1448v1 [physics.soc-ph] arxiv.org/abs/1202.1448

Abstract

Society's drive toward ever faster socio-technical systems, means that there is an urgent need to understand the threat from 'black swan' extreme events that might emerge. On 6 May 2010, it took just five minutes for a spontaneous mix of human and machine interactions in the global trading cyberspace to generate an unprecedented system-wide Flash Crash. However, little is known about what lies ahead in the crucial sub-second regime where humans become unable to respond or intervene sufficiently quickly. Here we analyze a set of 18,520 ultrafast black swan events that we have uncovered in stock-price movements between 2006 and 2011. We provide empirical evidence for, and an accompanying theory of, an abrupt system-wide transition from a mixed human-machine phase to a new all-machine phase characterized by frequent black swan events with ultrafast durations (<650ms for crashes, <950ms for spikes). Our theory quantifies the systemic fluctuations in these two distinct phases in terms of the diversity of the system's internal ecology and the amount of global information being processed. Our finding that the ten most susceptible entities are major international banks, hints at a hidden relationship between these ultrafast 'fractures' and the slow 'breaking' of the global financial system post-2006. More generally, our work provides tools to help predict and mitigate the systemic risk developing in any complex socio-technical system that attempts to operate at, or beyond, the limits of human response times.

© 2011 PhysOrg.com