New technology pinpoints anomalies in complex financial data

Identifying atypical information in financial data early could help identify problematic financial trends such as the systemic risk that recently put the U.S. and global financial systems in a downward fall. Recognizing such anomalous information can also help regulators, investors and advisors better manage their investment and savings portfolios.

Now, new analytical software developed by Battelle researchers based in Richland at the Department of Energy's Pacific Northwest National Laboratory can do just that. The technology has been licensed by Battelle to financial services company V-INDICATOR ANALYTICS, LLC, of Spokane, Wash.

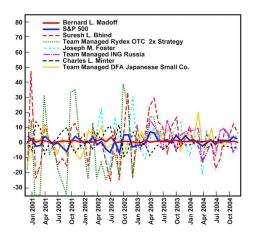

In a demonstration of this technology, the Battelle-developed Anomalator software recently picked out the atypically stable and positive returns reported by disgraced financier Bernard Madoff as an anomaly among hundreds of funds. He is now serving a 150-year prison sentence for scamming investors out of as much as $65 billion in a Ponzi scheme that spanned at least 20 years. Unfortunately, Madoff's fraud was concealed for more than 15 years. The use of this sophisticated anomaly-detection and visualization tool could have exposed Madoff early on, and can help expose future scandals, its inventors say.

"The Great Recession of the late 2000s has shown how questionable financial practices can place America's economy at serious risk," said John McEntire, the Battelle commercialization manager who licensed the technology to V-INDICATOR. "The Anomalator provides the unbiased, fact-based analysis needed to identify those problematic practices and help protect the nation's economy."

Traditional financial analysis reports either provide a list of numbers or a simple line graph to represent the value of just one investment over time. The Anomalator is unique in its ability to identify unusual trends in complex financial data and graphically show how it compares with larger datasets.

Anomalator uses mathematical algorithms to identify the atypical data in databases that record the movement of funds or the people who manage them over time. The software then creates a line graph representing the progress of anomalous funds or managers, as well as other user-selected funds or managers of interest.

Visual data analysis for the financial field

V-INDICATOR President Burton "Bud" Sheppard learned that Battelle and PNNL had a long history of visually analyzing data for homeland security applications. Researchers and commercialization managers from Battelle agreed to help him develop new visual analytics software. Battelle put up its own, private technology maturation funds to finance the development and then granted a license to V-INDICATOR to market the software for use in the financial services industry.

Homing in on the tool's potential to detect financial fraud, V-INDICATOR compiled Madoff's stated returns from one of the leading Madoff feeder funds. Battelle and V-INDICATOR researchers ran several scenarios and found that while the majority of the market was volatile, repeatedly spiking up or down, Madoff's returns were atypically upward sloping and effectively never lost money. This technology's unique anomaly-detection and visualization helps expose glaringly anomalous patterns such as those produced by Madoff.

"There's virtually nobody who duplicates Madoff's straight line and that could or should have been a dead giveaway to anybody who was looking at the data," said Sheppard. "Unfortunately, this anomaly wasn't caught until billions of dollars had already been lost. But financial firms and overseers can detect such crimes now with the help of the Anomalator."

V-INDICATOR is currently working with financial industry leaders to apply Anomalator software to critical problems addressed by the Dodd-Frank legislation and its regulations. Applications span systemic risk to funds, derivatives, stocks, bonds and other financial instruments — and uses including regulatory, wealth management, fiduciary, forensic, advisory and asset management and monitoring.

Provided by Pacific Northwest National Laboratory