Student loan default rates jump

The number of borrowers defaulting on federal student loans has jumped sharply, the latest indication that rising college tuition costs, low graduation rates and poor job prospects are getting more and more students over their heads in debt.

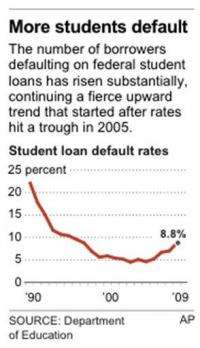

The national two-year cohort default rate rose to 8.8 percent last year, from 7 percent in fiscal 2008, according to figures released Monday by the Department of Education.

Driving the overall increase was an especially sharp increase among students who borrow from the government to attend for-profit colleges.

Of the approximately 1 million student borrowers at for-profit schools whose first payments came due in the year starting Oct. 1, 2008 - at the peak of the financial crisis - 15 percent were already at least 270 days behind in their payments two years later. That was an increase from 11.6 percent last year.

At public institutions, the default rate increased from 6 percent to 7.2 percent and from 4 percent to 4.6 percent among students at private not-for-profit colleges.

"I think the jump over the last year has been pretty astonishing," said Debbi Cochrane, program director for the California-based Institute for College Access & Success.

Overall, 3.6 million borrowers entered repayment in fiscal 2009; more than 320,000 had already defaulted last fall, an increase of 80,000 over the previous year.

The federal default rate remains substantially below its peak of more than 20 percent in the early 1990s, before a series of reforms in government lending. But after years of steady declines it has now risen four straight years to its highest rate since 1997, and is nearly double its trough of 4.6 percent in 2005.

Troubling as the new figures are, they understate how many students will eventually default. Last year's two-year default rate increased to more than 12 percent when the government made preliminary calculations of how many defaulted within three years. Beginning next year, the department will begin using the figure for how many default within three years to determine which institutions will lose eligibility to enroll students receiving government financial aid.

The figures come as a stalled economy is hitting student borrowers from two sides - forcing cash-strapped state institutions to raise tuition, and making it harder for graduates to find jobs. The unemployment rate of 4.3 percent for college graduates remains substantially lower than for those without a degree. But many student borrowers don't finish the degree they borrow to pay for.

The Department of Education has begun an income-based repayment plan that caps federal loan payments at 15 percent of discretionary income. And new regulations the Obama administration has imposed on the for-profit sector have prompted those so-called proprietary colleges to close failing programs and tighten enrollment. Both developments could help lower default rates in the future.

Administration officials took pains to praise the for-profit sector for recent reforms, but also said flatly that those schools - along with the weak economy - are largely to blame for the current increases. Among some of the largest and better-known operators, the default rate at the University of Phoenix chain rose from 12.8 to 18.8 percent and at ITT Technical Institute it jumped from 10.9 percent to 22.6 percent.

"We are disappointed to see increases in the cohort default rates for our students, as well as students in other sectors of higher education," said Brian Moran, interim president and CEO of APSCU, the Association of Private Sector Colleges and Universities, which represents the for-profit sector. He said for-profit schools were taking remedial steps, including debt counseling for students, to bring down the rates.

"We believe that the default rates will go down when the economy improves and the unemployment rate drops," he said.

Officials for Phoenix, owned by Apollo Group, Inc., and ITT, owned by ITT Educational Services, did not immediately respond to requests for comment.

The department emphasized that it eventually manages to collect most of the money it's owed, even from defaulters. But that's part of the reason federal student loan defaults are so hard on borrowers - they can't be discharged in bankruptcy. Defaulting can also wreck students' credit and keep them from being able to return to school later with federal aid.

"There are very few avenues for escaping that," Cochrane said. Also, "many employers these days are starting to check credit so it can hurt your job prospects."

According to calculations by TICAS and using the latest available figures, in 2008 average debt for graduating seniors with student loans was $20,200 at public universities, $27,650 at private non-profits and $33,050 at private for-profits.

©2011 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.