This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Demand for low-quality credits undermines the voluntary carbon market: Study

Claims by large corporations of carbon reduction—or even carbon neutrality—may not hold up under close inspection.

In a Nature Communications study, researchers at Kyoto University have shown that the 20 companies retiring the most offsets from the voluntary carbon market—or VCM—over the past four years have largely relied on low-quality, low-cost credits. These include major oil companies, airlines and aircraft makers, automotive manufacturers, logistics operators, and others.

"Concerns are growing that many projects supplying carbon credits on the VCM are of low quality and fail to achieve the emissions reductions claimed by their developers," says lead author Gregory Trencher of KyotoU's Graduate School of Global Environmental Studies. The companies studied collectively account for more than one-fifth of all offsets retired from the world's offset registries.

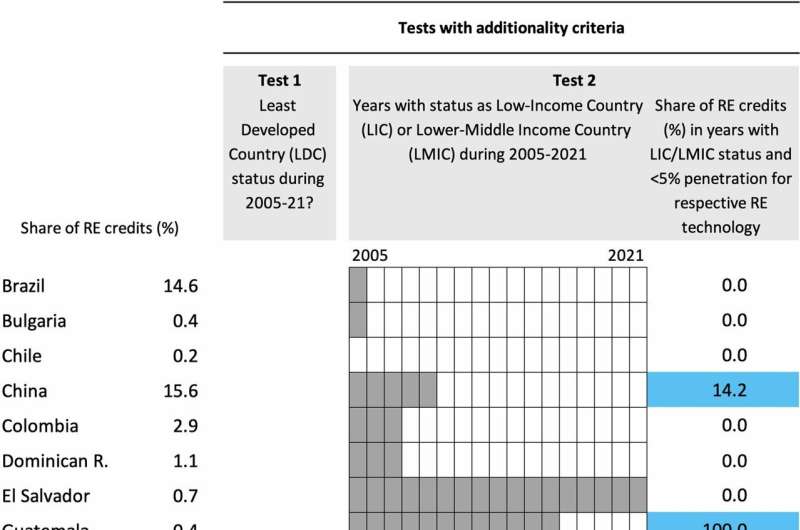

The research is based on an original, publicly available dataset that tracks offset retirements made between 2020 and 2023, encompassing the largest three offset registries in the VCM: Verra's Verified Carbon Standard, the United Nation's Clean Development Mechanism, and Gold Standard. The collaborative study includes co-authors at EPFL in Switzerland and the University of Hamburg.

The team's analysis reveals that none of the 20 companies could claim that a substantial portion of their retired offsets met well-known quality standards on the VCM. The study also found that many companies deliberately targeted cheap offsets, most of which come from projects implemented a decade or more ago. This indicates that most company spending on offsetting has failed to drive new investments in climate mitigation.

"This suggests that the VCM's unresolved quality issues stem not only from the supply side, but also from the demand-side, particularly from the purchasing decisions made by individual companies," continues Trencher.

These conclusions are especially concerning given that all but one of the 20 companies have set a net-zero climate target, with many also offering services touted as "climate neutral," only adding to a view that many firms are "greenwashing" their records.

"Prevailing offsetting practices on the VCM cannot be seen as an effective substitute for robust government policies that mandate physical changes in the energy technologies, supply chains, and business models of large emitters," says Trencher.

More information: Gregory Trencher et al, Demand for low-quality offsets by major companies undermines climate integrity of the voluntary carbon market, Nature Communications (2024). DOI: 10.1038/s41467-024-51151-w

Journal information: Nature Communications

Provided by Kyoto University