This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Researchers find crucial gaps in climate risk assessment methods

Researchers from the Universities of Zurich, Vienna and Utrecht have uncovered significant flaws in current climate risk assessment techniques that could lead to a severe underestimation of climate-related financial losses for businesses and investors.

A study by Stefano Battiston of the Department of Finance at the University of Zurich and his co-authors, published in Nature Communications, has identified critical shortcomings in the way climate-related risks to corporate assets are currently assessed.

Many current estimates of climate physical climate risk rely on simplified and proxy data that do not accurately represent a company's true risk exposure. This can lead to significant underestimates of climate-related losses, with serious implications for business investment planning, asset valuation and climate adaptation efforts.

Potential losses up to 70% higher than previously estimated

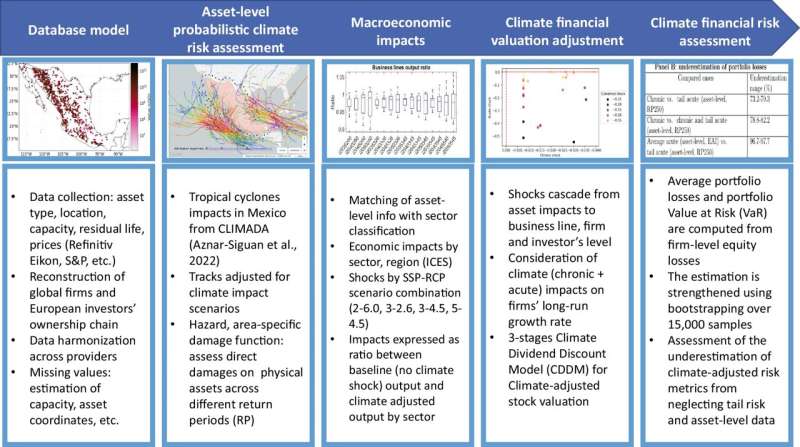

The research team developed a new methodology that uses detailed information about the location and characteristics of a company's physical assets, such as factories, equipment and natural resources. This approach provides a more accurate picture of climate risks than methods that use proxy data, which often assume that all of a company's assets are located at its headquarters.

"When we compared our results with those using proxy data, we found that the potential losses from climate risks could be up to 70% higher than previously thought," says Battiston. "This underscores the critical need for more granular data in risk assessments."

Preparing for the worst: The role of extreme events

The authors also point to the importance of considering "tail risk" in climate assessments. Tail risk refers to the possibility of extreme events that, while rare, can have catastrophic impacts.

"Many assessments focus on average impacts. Our research shows that the potential losses from extreme events can be up to 98% higher than these averages suggest," says Battiston. "Failure to account for these possibilities can leave businesses and investors dangerously unprepared."

More funding for climate adaptation

The study's findings have significant implications for climate policy, business strategy, and investment decisions. The researchers emphasize that more accurate risk assessments are crucial for developing effective climate adaptation strategies and determining appropriate levels of climate-related insurance and funding.

"Our work shows that we may be seriously underestimating the financial resources needed for climate adaptation," concludes Battiston.

More information: Giacomo Bressan et al, Asset-level assessment of climate physical risk matters for adaptation finance, Nature Communications (2024). DOI: 10.1038/s41467-024-48820-1

Journal information: Nature Communications

Provided by University of Zurich