This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

MakerDAO from a traditional finance perspective: Researchers analyze DeFi project

Decentralized finance systems (DeFi) is a new blockchain-based solution, where transactions are carried out automatically through smart contracts without any intermediaries (banks, brokers, etc.), while users have direct control over their assets.

So far these systems have little impact on the global financial market, but it has the potential for rapid growth. A research team from Skoltech and the Higher School of Economics analyzed the MakerDAO DeFi project through the lens of traditional finance. The results are available in the IEEE Access journal.

"If classical financial systems are well-regulated—for example, Russia and 28 other jurisdictions adhere to the Basel framework—cryptocurrencies are still a gray area," commented Yury Yanovich, a co-author of the study and a senior research scientist at the Wireless Center at Skoltech. "We focused on the MakerDAO project, whose users can get a loan in cryptocurrency secured by another cryptocurrency, and assessed the risks of the project."

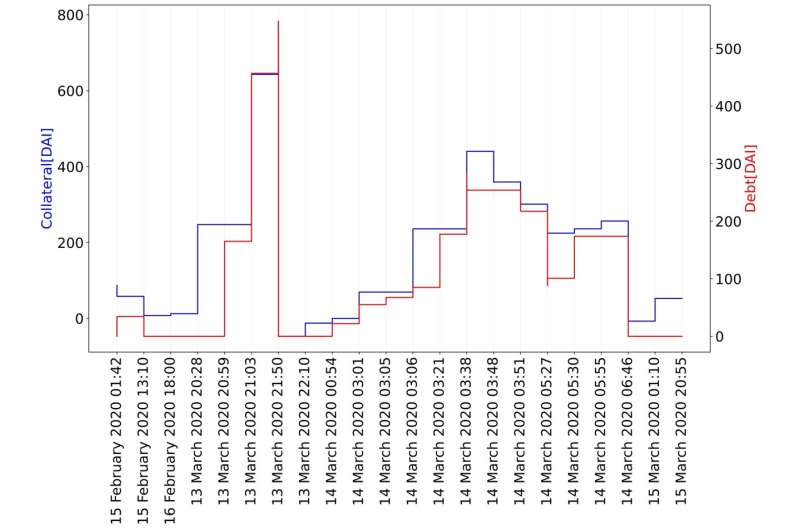

MakerDAO is an open-source platform based on the Ethereum blockchain and a decentralized autonomous organization created in 2014. Management rights are distributed among holders of Maker tokens (MKR). The user blocks various types of tokens as "collateral" in the MakerDAO app in exchange for DAI stable coins and a stabilization commission, as well as new application management tokens (MKR).

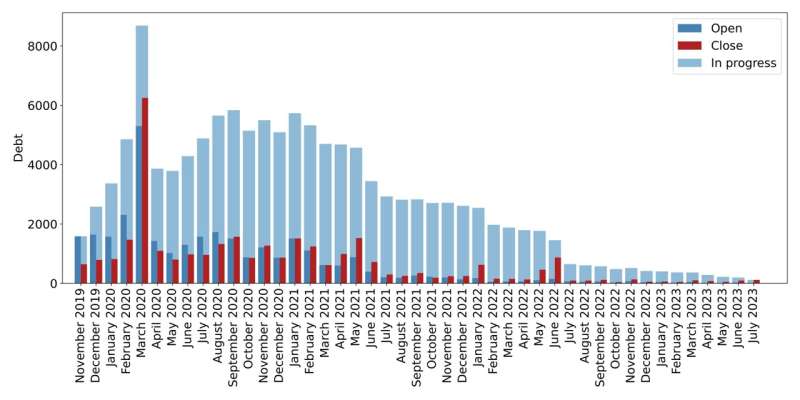

The research team collected the first of its kind dataset on the MakerDAO users—their loan portfolios, considering such characteristics as balance, loss given default, annual equivalent rate, and probability of default.

"Our approach is distinct in that we viewed decentralized finance projects from the perspective of classical finance. Thanks to our expertise, we were able to obtain data that appeared to be publicly available, but processing it is challenging due to the complexity of technical protocols.

"To our knowledge, we are the pioneers in extracting data from a large DeFi project and processing it in a standard way, similar to classical finance. The sample can help other researchers, for example, to train models that predict the default risk of individual borrowers," continued Yury Yanovich.

The team also calculated the effective interest rate that borrowers pay in cryptocurrency. If for those users who service their debt successfully it ranged from 0.5% to 4%, for those who at some point failed to meet their obligations it exceeded 100% per annum. The researchers analyzed the risks of default using a special mathematical model.

"In classical financial systems, it is assumed that borrowers are independent of each other, and the chance that they will not repay the debt is in no way related between the two borrowers. In MakerDAO, the situation is different: since all borrowers leave cryptocurrencies as a loan—in most cases, Ethereum cryptocurrency—the price of collateral for all of them depends on the same underlying asset.

"When the price of this asset falls, all borrowers risk failing the debt servicing. Thus, it cannot be assumed that they are all independent of each other. In this regard, we have made a special model that takes this circumstance into account. The model is based on the intersection of lines of random walk levels," Yury Yanovich added.

As the authors noted, the study enhances understanding of the loan and disbursement processes in DeFi projects and also offers a standardized approach to analyzing loan portfolios of participants in these projects.

More information: Yatipa Chaleenutthawut et al, Loan Portfolio Dataset From MakerDAO Blockchain Project, IEEE Access (2024). DOI: 10.1109/ACCESS.2024.3363225

Journal information: IEEE Access

Provided by Skolkovo Institute of Science and Technology