This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

New study on how governments can fund radical ecological and social policies without GDP growth

According to a new study led by a researcher at Freie Universität Berlin's Otto Suhr Institute of Political Science, the level of gross domestic product (GDP) has no impact on the ability of states with monetary sovereignty to fund investments in radical decarbonization measures and ambitious social policies such as universal public services and a job guarantee. The study, "How to pay for saving the world: Modern Monetary Theory for a degrowth transition," has just been published in the journal Ecological Economics.

"Halting global climate collapse requires massive increases in public spending. Only through public investment can we achieve a timely transition away from fossil fuels," says Christopher Olk, a doctoral researcher at the Otto Suhr Institute of Political Science at Freie Universität Berlin and lead author of the study.

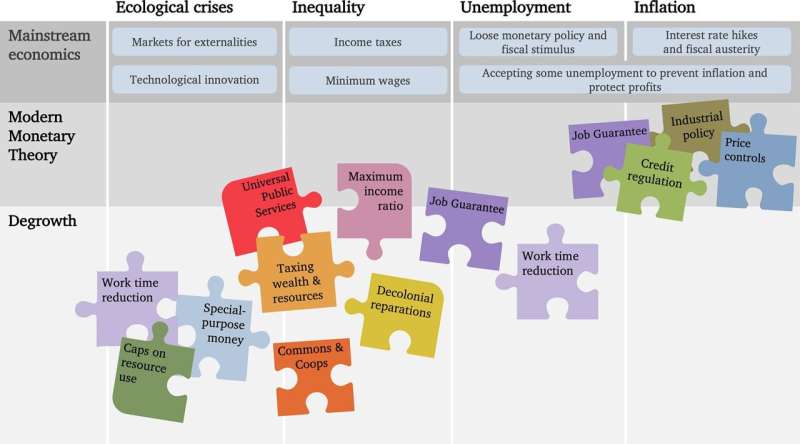

It is widely believed that governments can only increase spending if they first grow GDP to increase tax revenue, otherwise they risk inflation or "unsustainable" levels of public debt. This presents a problem, because GDP growth works against ecological objectives. Indeed, a majority of climate scientists is now calling for "degrowth"—a democratically planned, equitable reduction of less necessary forms of production—in high-income countries in order to enable faster decarbonization. Key degrowth measures include the expansion of universal public services and a job guarantee in sustainable sectors.

Degrowth presents governments with the question of how to finance the necessary ecological and social measures during this process of transformation—a question that Olk and his fellow research team members want to answer. They argue that public investment can be increased without GDP growth and that the process of degrowth simultaneously dismantles destructive, less necessary industries and prevents inflation.

The article draws on Modern Monetary Theory (MMT) to explain why states with monetary sovereignty are not subject to financial constraints. "Contrary to what conservative economists claim, public spending is not actually constrained by tax revenues, but by the productive capacity of the economy," explains Olk.

The limits of public spending are therefore the social and environmental limits of production. According to Olk, for public investment in rapid decarbonization to occur, some resources that have thus far been used for production that is less necessary on a social level must be shifted to sustainable sectors through targeted policies.

To this end, the researchers propose a comprehensive set of monetary and fiscal policies to prevent inflation and ensure economic stability during a degrowth transition. These include: stronger regulation of private money creation by banks; progressive taxation of capital income, as well as of energy and resource consumption; targeted price controls; robust public utility systems; and the introduction of an emancipatory, democratically organized job guarantee in sustainable sectors. This holistic policy framework has the potential to build broad democratic support for a transition to a more sustainable future.

"Governments are not doing what is necessary to protect our livelihoods in the face of an escalating climate crisis," explains Olk. "But people can only demand better if they understand that climate inaction is not justified by any macroeconomic constraints. It is exclusively a matter of political power."

A number of debt rules at the European and national level pose legal obstacles to the necessary public spending. In view of the existential threat that the climate crisis poses, the researchers suggest suspending these rules, as decision makers did during the COVID-19 pandemic, or eventually replacing them with a more democratic governance framework.

According to the authors of the study, Christopher Olk, Colleen Schneider (Vienna University of Economics and Business), and Jason Hickel (Universitat Autònoma de Barcelona and the London School of Economics), degrowth requires above all a politically well-organized social base. Concerns about financial feasibility, inflation, and living standards often lead to widespread skepticism about the possibility of a radical social and ecological transformation.

In this study, the authors address these concerns, demonstrating how such a transition is macroeconomically feasible, and propose a practical economic policy program that allows for ecological and social goals to be achieved at the same time.

More information: Christopher Olk et al, How to pay for saving the world: Modern Monetary Theory for a degrowth transition, Ecological Economics (2023). DOI: 10.1016/j.ecolecon.2023.107968

Provided by Freie Universität Berlin