This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Do investors incorporate financial materiality of environmental information in their risk evaluation?

Financial materiality pertains to crucial and pertinent data that a company is obligated to reveal in its financial statements. It provides companies with the insights necessary to discern elements influencing their performance and profitability, thereby enabling them to mitigate risks and captivate potential investors.

There have been conflicts between shareholders and stakeholders regarding issues that are not directly related to finances, like environmental and social concerns. However, ignoring these factors like ESG (environmental, social and governance) could pose risks to both companies and investors.

Researchers at Kyushu University found that investors consider a company's response to material environmental issues as a significant risk when deciding whether to invest in it or not. This highlights the importance of providing information that promotes communication between companies and investors for sustainable investment. The research is published in the journal Corporate Social Responsibility and Environmental Management.

The more people become interested in sustainable investing, the concept of financial materiality is being closely examined. The Sustainability Accounting Standards Board (SASB) has developed specific standards for different industries to help companies disclose sustainability information that is financially relevant.

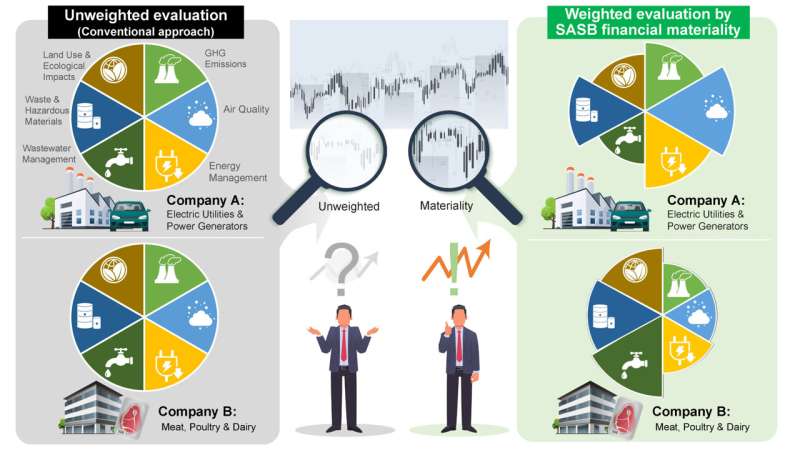

The study analyzed data from 1,766 companies listed in the US between 2011 and 2020. By incorporating financial materiality into environmental performance assessments, this study provides new evidence of sustainability investments from the perspective of shareholders. The researchers made three important findings:

- The importance of each evaluation criterion for sustainable investment varies depending on the characteristics of each company.

- Shareholders see a lack of consideration for financial materiality in management strategies as a significant risk.

- Evaluating a company's environmental performance based on financial materiality provides a better perspective for investors to understand the environmental risk involved.

With the growing interest in sustainable investing, there is a need to reevaluate how environmental information is reported by companies. Considering ESG factors in investment strategies provides scientific evidence for the importance of including financial materiality to achieve a sustainable and resilient economy. Using the financial materiality standards provided by SASB could be an effective way to assess and manage corporate environmental risks.

More information: Jun Xie et al, Do investors incorporate financial materiality? Remapping the environmental information in corporate sustainability reporting, Corporate Social Responsibility and Environmental Management (2023). DOI: 10.1002/csr.2524

Provided by Kyushu University