This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Portfolio optimization methods for highly volatile assets: Challenges and solutions

Portfolio optimization is a crucial aspect of managing finances for institutions. It involves deciding how to distribute wealth among different assets. Traditional methods of portfolio optimization have limitations, especially when there are many assets or extreme values, which can lead to unstable outcomes. Addressing these challenges, a new study introduces a promising approach called the minCluster portfolio method. It is specifically designed for highly volatile markets, including those involving cryptocurrencies.

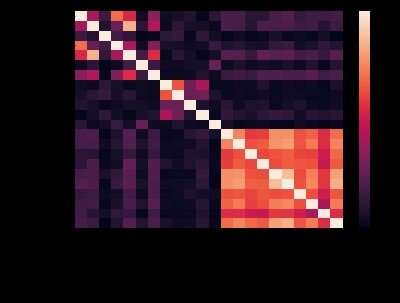

"The minCluster method combines different techniques to achieve the best allocation of assets in a portfolio. It uses a unique way of analyzing the relationships between assets and considers the downside risk," said Emmanuel Jordy Menvouta, first author of the study. "This allows it to find the best combination of assets, even in highly unpredictable markets. The methodology used in this approach has the potential to be applied to other areas beyond portfolio optimization."

The research findings show that the minCluster portfolio optimization method is effective in constructing robust portfolios in highly volatile markets. This has significant implications for investors and portfolio managers who want to optimize their portfolios in challenging market conditions. Notably, the minCluster method consistently outperforms traditional approaches in tests conducted outside the sample. By using robust techniques and considering downside risk, this approach has the potential to improve portfolio performance and reduce the impact of losses.

Menvouta and his co-authors published their findings in The Journal of Finance and Data Science. "This is the first paper to combine ideas from robust statistics, machine learning, and portfolio optimization. It opens up new avenues for building portfolios that can handle extreme situations and perform well in highly volatile markets," added Menvouta.

The team believes that further research may explore how the minCluster method performs with different datasets and market conditions.

More information: Emmanuel Jordy Menvouta et al, Portfolio optimization using cellwise robust association measures and clustering methods with application to highly volatile markets, The Journal of Finance and Data Science (2023). DOI: 10.1016/j.jfds.2023.100097

Provided by KeAi Communications Co.