This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Investing smartly in climate change adaptation

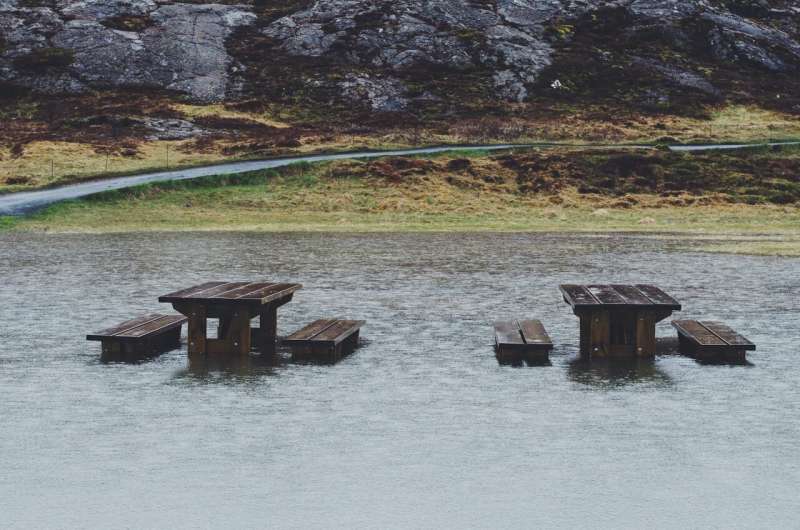

Until the world stops or slows our greenhouse gas emissions, we won't know just how severe climate change effects like sea level rise and extreme weather will be. A new framework could help communities when making often irreversible climate adaptation decisions under this uncertainty—so they're not spending so much that they're left servicing unnecessary debt, and not spending so little that they're left unprotected.

Graeme Guthrie, a New Zealand economics researcher, suggests the framework says adaptation decisions like stormwater upgrades are mostly made by local authorities with limited analytical resources, so it's designed to be easily used at the local scale.

The scale of public investment needed to successfully adapt to climate change will depend on the magnitude of that change. For example, communities will need to increase the capacity of their stormwater systems to cope with intense rainfall, but they do not know how much additional capacity will be required. The situation facing Dunedin is typical. NIWA estimates that a 1-in-100 year rainfall event will currently see 141mm of rain falling in a 24-hour period. By 2090, this estimate increases to 148mm under RCP2.6 and 172mm under RCP8.5.2 The demands on Dunedins stormwater system, and the amount of new investment required, depend crucially on which climate scenario unfolds.

Uncertainty about the magnitude of climate change will remain high for many years (decades, according to some experts), before gradually falling as scientists learn more about the change in climate. If climate change is less severe than communities expect, they may end up spending too much on adaptation; if it is more severe than expected, they may not spend enough. The nature of adaptation investment makes these errors extremely costly for society. Much adaptation investment will be irreversible, so if communities build too much, they will be left servicing debt used to build capacity they will never need. On the other hand, if communities do not build enough, they will either be stuck with high flooding costs in the future or they will need to invest again—with all the additional cost that entails. The final option—that communities delay investment until they have a clear idea of how much capacity will be needed—would leave communities under-protected in the meantime.

There are no low-cost adaptation options, but some options are less costly than others. Policymakers aim should be to choose adaptation options that minimize the overall cost to society, where these costs include the funds spent on adapting and the costs incurred by the community when flooding and other weather-related events occur.

Real options analysis (ROA) is an ideal decision-support tool because it can handle the flexibility embedded in investment programs, such as the ability to accelerate, delay, or rescale investment. It takes mathematical techniques originally developed for pricing particular types of financial securities and uses them to calculate the values of the various investment options available to decision-makers. Of these options, perhaps the most important one is the option to wait, learn more about the magnitude of climate change, and then invest. Investment is only socially optimal if the payoff from investing is greater than the option value of waiting.

This paper, which has been published in the Journal of Economic Dynamics and Control, presents a new real options framework that incorporates current uncertainty about climate change and how that uncertainty might change over time. It uses this framework to investigate the best way to upgrade an urban stormwater system in response to future climate change. Optimal investment policies can be expressed in many equivalent forms, but the most useful one involves the benefit-cost ratio. Whenever investment might occur, we can calculate the ratio of the present value of the projects future benefits to the present value of the future costs. If this ratio is high enough, then it is optimal to invest. Standard cost-benefit analysis leads to investment occurring as soon as this ratio is greater than one, but this paper shows that such a policy is far too aggressive. It is typically optimal to wait until a projects benefits are much greater than its costs before investment is truly optimal—at least 60% higher for the baseline case considered in the paper. The investment criterion is even more demanding when economic conditions are more volatile, when expected economic growth is faster, and when climate change is expected to be more severe.

Much adaptation spending will fund relatively small projects under the jurisdiction of local authorities. These authorities have the local knowledge and incentives that are essential to good decision-making, but many of them have limited analytical resources. This is unfortunate because real options analysis can be complex and resource intensive. It is not widely used, particularly for relatively small projects. If society is to retain the benefits of local decision-making, then the decision-makers need approaches that are simple enough to be useful for evaluating small- and medium-scale adaptation decisions yet retain a degree of economic rigor. This paper proposes one such approach.

The most difficult part of ROA is calculating the option value of waiting. The alternative approach developed in this paper uses tools that are familiar to most practitioners to calculate an approximate option value of waiting. The alternative rule involves replacing the fully optimal value of the delay option with its value assuming investment is delayed until the best fixed future date, which requires one standard cost-benefit calculation for each possible future investment date. The approximate option value is the maximum of these values. A decision-maker using this alternative rule invests once no fixed future investment date implies a greater net present value than investing immediately. Investment is delayed significantly past the date when the benefit-cost ratio equals one, but it still occurs earlier than under the optimal investment policy.

For the next few decades at least, the acceleration in investment compared to optimal investment timing is moderate. The welfare losses that result from using this simple rule are remarkably small, usually just a few percent of the level of welfare if full ROA is used instead. These welfare losses are only substantial if economic conditions are very volatile, expected economic growth is low, and climate uncertainty will fall rapidly. However, for typical projects in typical conditions, it appears to be possible to capture most of the benefits of full ROA using simple techniques that will make scarce analytical resources stretch further.

This paper is the first output of a larger project supported by the Deep South Challenge as part of its "Living With Uncertainty" program. The second stage of this project, which is currently underway, investigates richer option structures and evaluates the performance of even simpler alternatives to full ROA.

More information: Graeme Guthrie, Optimal adaptation to uncertain climate change, Journal of Economic Dynamics and Control (2023). DOI: 10.1016/j.jedc.2023.104621

Provided by Victoria University of Wellington