Shared political views have moderating influence on cross-border mergers and acquisitions

Investors react more negatively to transactions between firms in different countries if there is evidence of weak political affinity, a new study suggests.

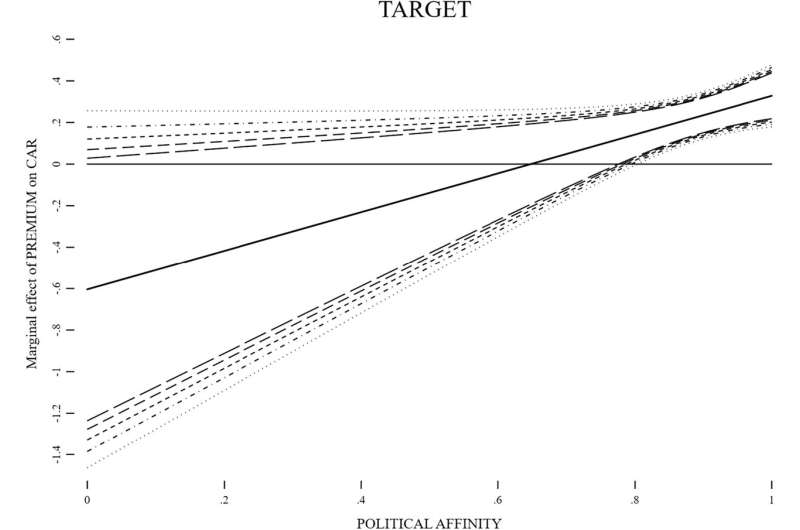

The study, published in Strategic Management Journal, looked at whether investors use political affinity information to assess the reliability of premiums—the price paid above the target firm's value—to secure a deal.

When one public company buys another, investors are left to decide whether the premium is an overpayment and if the deal is good or bad news.

Typically, value is wiped off the acquiring firm's shares due to investor fears about overpayment, and the target firm's share price tends to rise.

Researchers from the University of Exeter Business School, the University of Bremen and University of Hamburg examined 1,183 cross-border acquisitions between 1999 and 2018 and found that investors assess a deal and the premium differently depending on political affinity.

They found that when companies are based in countries with strong political affinity such as the UK and US, investors in both the acquiring and target firms react more moderately to the premium paid.

But when political affinity is weak, such as between the US and China, investors worry that the premium paid is an overpayment, and concerns about government intervention and whether the deal will go through result in value being wiped off the share price.

The researchers used voting behavior at the UN General Assembly over the past 10 years as a proxy for political affinity.

The data allowed the researchers to see how close UN member countries were on a range of global political issues at any time during the past decade.

According to Professor Sebastian Tideman, a Lecturer in Finance and Accounting from the University of Exeter Business School, the findings should be of interest not only to business and investors but to politicians too.

"The findings show there's a heavy cost to firms when you have too much disagreement between nations, with cross-border acquisitions leading to value to be wiped off a company's share price.

"Governments that want to maintain a healthy and open capital market should be aware of this, and businesses when they acquire other companies must remember to be careful who they select and factor in that investors will react more negatively if, for example, a US company is buying a Chinese firm as opposed to a UK one.

"If you can get similar deal conditions, it's better to pick the company either in the same country or with a high level of political affinity, and don't try to acquire a firm in a country where there is weak political affinity."

The researchers highlighted Microsoft's reported attempt to buy a stake in Chinese social media company TikTok as an example of how political tensions can harm deals between companies in different countries.

Microsoft was reportedly interested in becoming a minority investor in the video-sharing app, a prospect that resulted in US President Donald Trump signing an executive order threatening to ban TikTok in the US, saying it posed a security threat.

"It goes to show that all that we see now, with tensions in countries such as Russia, the Ukraine and China, is costly for the capital market and costly for acquiring and target firms alike."

The study "Political affinity and investors' response to the acquisition premium in cross-border M&A transactions—a moderation analysis" by Professor Sebastian Tideman and co-authored by Professor Christian Fieberg, Professor Kerstin Lopatta and Professor Thomas Tammen, is published in the Strategic Management Journal.

More information: Christian Fieberg et al, Political affinity and investors' response to the acquisition premium in cross‐border M&A transactions—A moderation analysis, Strategic Management Journal (2021). DOI: 10.1002/smj.3325

Provided by University of Exeter