A decade after Deepwater, BP faces new existential challenges

Ten years after an oil spill that BP's new boss Bernard Looney admits tested the company "to the core", the firm is facing two existential challenges: the collapse of prices and climate change.

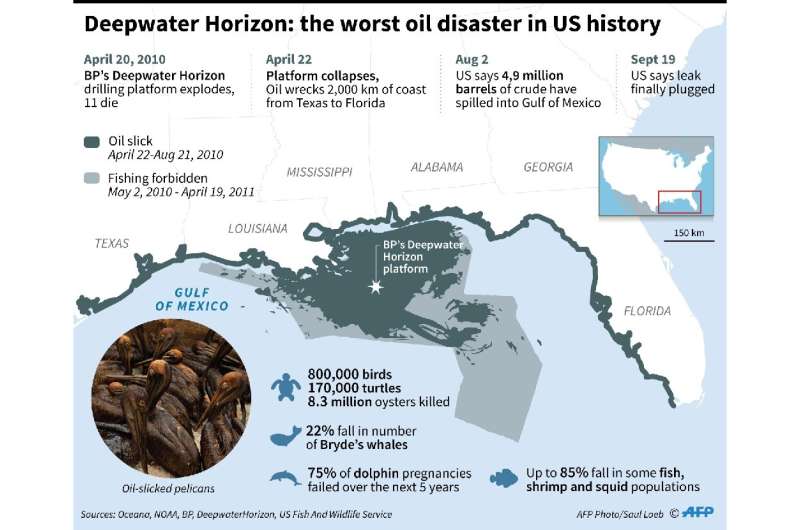

It was a decade ago this week that an explosion on the Deepwater Horizon rig in the Gulf of Mexico triggered the worst oil spill in US history, killing 11 employees and ultimately costing the British firm more than $70 billion.

Speaking in February as BP announced plans to go carbon neutral by 2050, chief executive officer Looney said that "we learned some hard lessons we will never forget".

"We remember those lessons in this new decade, where the big challenge for BP is the one the world faces: climate change," he said.

Anglo-Dutch oil giant Royal Dutch Shell has followed suit in pledging to become carbon neutral but the US groups and French firm Total are lagging behind.

BP says it has reformed its culture over the past decade to emphasise operational security and to prevent environmental damage, for example through a programme to detect methane leaks.

The company's latest figures show an increase in its oil spills from 124 in 2018 to 152 in 2019, but BP puts this down to acquisitions over the period.

The 2020s began amid greater pressure on multinationals to reduce their carbon emissions, from investor demands to dramatic protests by climate campaigners.

The global coronavirus pandemic has brought a new and unprecedented challenge for oil firms, causing a drop in demand that has sent prices plummeting.

The collapse in prices complicates the transition to cleaner energy for oil majors, because cheap oil makes green energy comparatively less attractive.

BP puts almost all of its $15 billion annual investment budget into fossil fuels, although it has acquired stakes in solar panel firms and electric vehicle charging companies worth a total of $400 million.

"Their basic business model hasn't changed," said Bobby Banerjee, professor of management at City, University of London.

"They invest most of their money in gas and oil" because "they're confident there will be demand for oil" in the next 50 to 70 years, he said.

He said for BP, the energy transition was all about shifting from oil to gas, which is still a polluting hydrocarbon.

"The return they get on fossil fuels is not the return they'll get on renewables," he said.

Changing the model

Russ Mould, investment director at AJ Bell, said after the Deepwater crisis BP shed some assets and bet on low oil prices in the long run, reducing its costs and making the group more resilient.

But it has huge debts, totalling some $45 billion at the end of 2019, leaving it vulnerable to a sustained drop in revenues.

Looney now faces a dilemma. He must decarbonise the group while preserving its profitability and share price, which has fallen by 40 percent since the beginning of the year, a plunge experienced by many rivals.

He has promised to say more in September about how he will reach his carbon neutral target and is expected to bet on gas, still untested carbon capture technology and renewables.

BP could also take advantage of carbon offsetting schemes, which involve investing in green projects but are heavily criticised by environmentalists.

For campaign group Greenpeace, the choice for the industry is clear: "Either becoming renewable energy companies or ultimately shutting down."

"The crash in the oil market is the closest thing BP and the rest of the global oil industry will get to a dress rehearsal for the transition to come," a spokesperson said.

© 2020 AFP