Bailout or subsidy: Oil in the age of pandemic

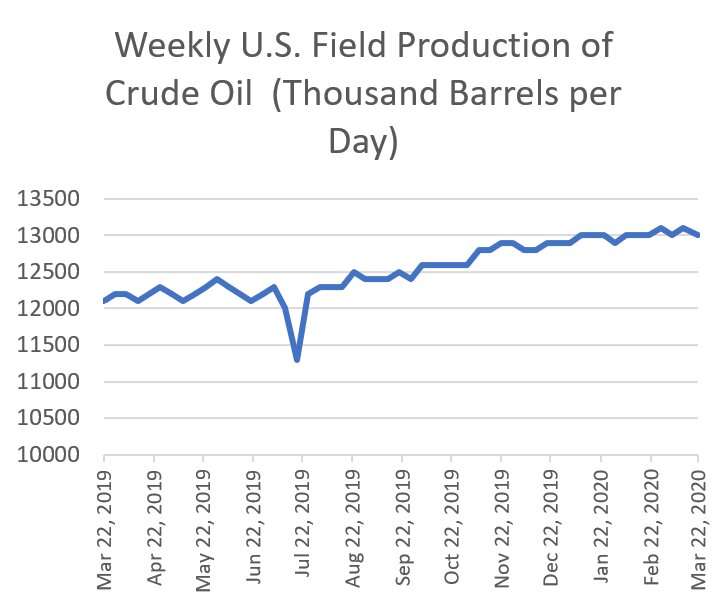

COVID-19 is disrupting all sectors of the global economy, and the energy sector is far from immune. As economic activity slows precipitously on its way to catastrophically, the fossil energy sector that drives part of that activity is responding. With crashing demand due to the pandemic, the first response is seen in prices. A barrel of oil now sells for $25 or less, down from over $60 at the beginning of 2020. The second response is seen in production. So far production has remained stable in the last two months, but companies have announced massive spending cuts that will soon constrain production.

But production hasn't stopped completely. Extraction and refining companies are likely selling for reduced profits or perhaps even at a loss. But there is something else going on that has big implications for both the government stimulus efforts and the shape of future economic recovery.

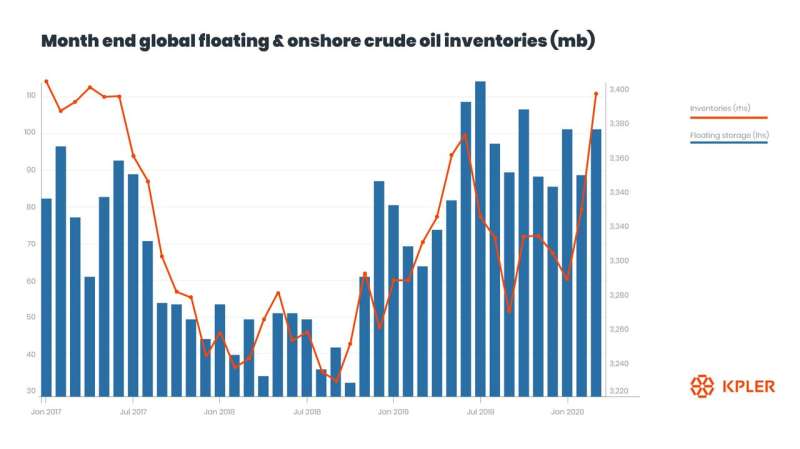

That something else is storage. Energy companies employ a variety of ways to store crude and refined products. There are vast storage tank facilities or underground caverns at points along the oil supply chain. There are also large capacities for storage in facilities normally devoted to transporting oil and its derivatives: tanker ships, tanker rail cars, tanker trucks, as well as long distance pipelines.

Fossil energy companies have strong incentives to continue extracting and refining as long as there is a place to store products until demand and price recover. The estimated gap between world oil supply and demand will be 7.4million barrels/d for the first quarter of 2020. Storage facilities are filling fast around the globe and soon will be full. According to commodity data, there are currently over 3.5 billion barrels of global crude oil inventories. This enormous global supply has large and complex implications for the eventual recovery of the global economy.

But our concern here focuses on the urgent question of how to design government assistance to fossil energy companies. This assistance is rightly characterized as a bailout, an extraordinary government effort to soften the blow of crashing demand and ensure that the damage done does not persist after demand returns.

In the United States, the recently approved Coronavirus Relief Package excluded $3 billion to "bail out" the oil industry. But that exclusion was at the last minute and at the behest of the Democratic caucus; next time, a stimulus package may well include a bailout for oil. In Canada, plans to rescue the industry are in the making. As prices continue to plummet, oil state producers in the U.S. and around the world will likely be exploring ways to provide relief to oil companies. Any of that assistance made available for oil must be designed to prevent an appropriate bailout from becoming a hidden subsidy. Any compensation for the costs of storing oil that sells for $25 a barrel now but might sell for $100 a barrel in a future recovery is not a bailout. Instead, it is subsidy that provides a future windfall for oil companies.

Assistance must soften the temporary effects of low demand: worker emergency pay, the costs of safe idling of refining equipment, and so on. In places where oil revenues represent a substantial part of government income, this assistance should be directed to ensure continuity in public expenditure.

And assistance must not further subsidize obstacles to a clean energy system—a system that provides lower total costs, safer operations, and healthier environmental performance.

Reasonable people can have a lively policy debate over how to subsidize a transition from fossil-fueled energy to carbon-free energy. But calling a subsidy a bailout is not how to do it.

Provided by University of Pennsylvania