Enhanced prediction for asset returns

NUS data scientists have developed an improved version of the Fama–French three-factor model to provide better estimations of the financial returns for business analysis.

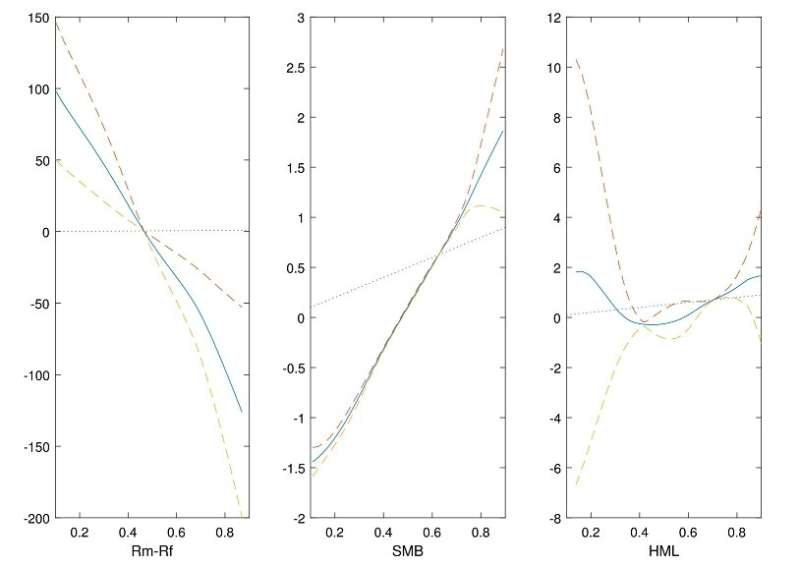

The Fama–French three factor model is commonly used in asset pricing and portfolio management to describe the returns from financial assets. The model uses primarily three factors to assess the returns which can be obtained from the stock market. These three factors are commonly referred to as the market (Rm-Rf), size (SMB) and value (HML). Rm-Rf is a measure of the market risk, which is the difference between the returns from the financial portfolio and the risk-free rate. The other two factors, SMB and HML, measure the historic excess returns of small companies over big companies and of value stocks over growth stocks. Although many other factor models were proposed in the literature, the Fama-French three factor model is widely favored for its computational simplicity and reliable prediction performance. However, the model is linear with fixed parametrization, which may be restrictive.

A research team led by Prof LI Jialiang from the Department of Statistics and Applied Probability, NUS has developed a more flexible nonparametric version of the Fama–French three factor model for improved prediction of the returns from a given financial portfolio. In their approach, the three factors are described by smooth nonparametric functions constructed using available historical data. This provides a more comprehensive characterization of the asset returns when compared to the initial model, which uses linear functions. The research team provided the theoretical justification for the methods used in the new approach in this work. They also carried out simulation studies using historical United States stock market data to validate the proposed approaches. Using their estimation methods, they found that linear functions may not fully capture the effects of the three factors and they could be better characterized by using nonparametric approaches.

Prof Li said, "In our study using historical financial data, the new approach can provide more accurate prediction, amounting to more than 35% improvement in terms of accounting for the return of an asset. In addition to analyzing the returns from assets, the improved version of the model can be adapted to provide better numerical results for a broader range of applications in the business and finance domains."

More information: Jialiang Li et al. Factor models for asset returns based on transformed factors, Journal of Econometrics (2018). DOI: 10.1016/j.jeconom.2018.09.001

Journal information: Journal of Econometrics

Provided by National University of Singapore