Boeing says suffering $1 bn hit from 737 MAX crisis

Aviation giant Boeing has suffered a $1 billion hit to its bottom line amid the crisis over its 737 MAX aircraft, grounded worldwide after two deadly crashes, the company said Wednesday.

In its first quarterly earnings report since entering crisis mode, Boeing also withdrew its 2019 profit forecast due to continued uncertainty about when the grounded jets will return to the skies.

Boeing has been under scrutiny since the March 10 crash of an Ethiopian Airlines jet, which along with an October Lion Air crash, claimed 346 lives.

Regulators grounded the plane worldwide following the second crash, a move that also forced the company to halt new deliveries of its most-ordered plane, denting revenues.

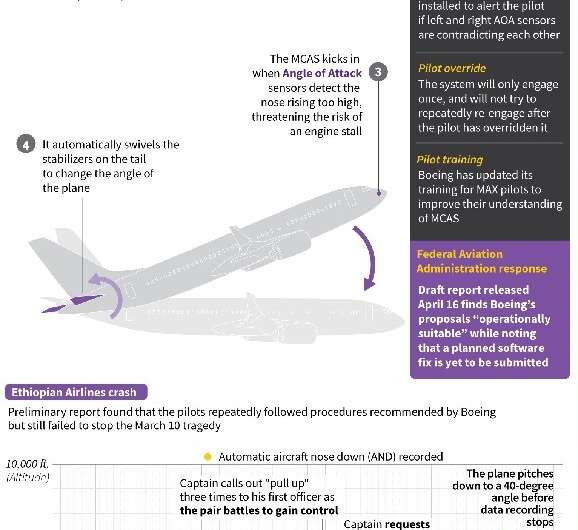

Company executives sketched out the steps needed to return the 737 MAX to service—including a fix to the flight software system implicated in the crashes—but offered no timetable.

Asked pointedly during a conference call with analysts for an explanation of what happened, the executives defended Boeing's design and engineering practices despite negative news exposes criticizing the company's operations and commitment to safety.

"I can tell you with confidence that we understand our airplane, we understand how the design was accomplished, how the certification was accomplished and we remain fully confident in the product that we put in the field," Chief Executive Dennis Muilenburg said in a conference call with analysts.

"There was no surprise, or gap or unknown here, or something that somehow slipped through a certification process."

But Muilenburg acknowledged the need to win back public trust and said the firm would enlist the help of pilots to reassure anxious customers, adding that "the bond between the passenger and the pilot is one that is critical."

The company's share price climbed following the earnings report, reflecting relief that the financial damage from the 737 MAX crisis was not worse.

Given Boeing's size, the financial hit to the company has been "modest so far," S&P Global Ratings said, but warned that the cash drain will continue until the company can resume deliveries.

Higher costs

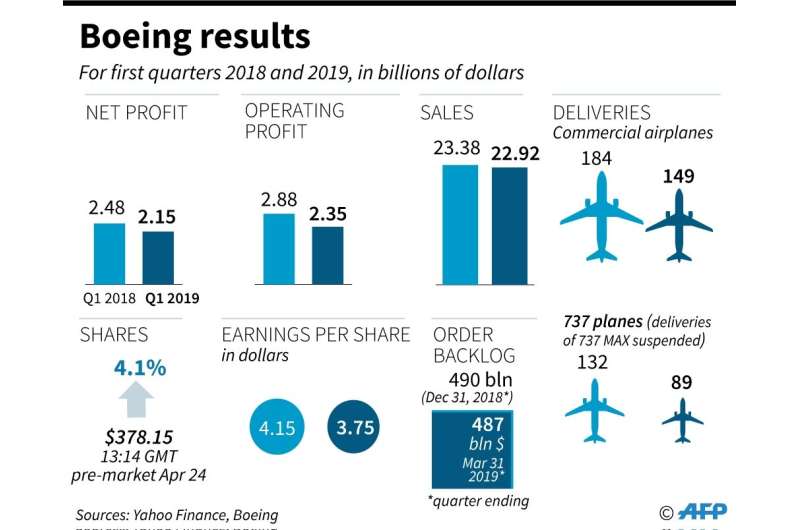

The US aerospace giant reported $2.1 billion in profits in the first quarter, a decline of 13.2 percent from same period a year ago due in part to the $1 billion hit from the 737 program. Revenues dipped 2.0 percent to $22.9 billion.

Boeing also pulled its full-year profit forecast, citing "uncertainty of the timing and conditions surrounding return to service of the 737 MAX fleet." The company in January projected higher earnings per share compared with last year, based on an expected revenue jump of as much as 10 percent.

The $1 billion hit in the quarter is the result of higher costs associated with maintaining the 737 building program and its staffing after Boeing cut production of the planes.

The company also spent additional funds in the quarter on a software fix to address problems in the anti-stall system believed to be a factor in both crashes, and for training associated with the fix.

The estimates do not include other expected costs, such as compensation to airlines for canceled flights, executives said. The company could also face costs from government probes and settlements with victims' families.

"We may also experience claims or assertions from customers and/or suppliers in connection with the grounding," Boeing said in a securities filing, adding that it was "unable" to estimate such costs at this time.

Muilenburg said advance payments from customers for new 737 MAX, which represent a small portion of the overall price-tag, are "for the most part coming in per schedule."

Numerous government probes

Boeing said it is "making steady progress" on the software fix and has conducted more than 135 test flights as it works with global regulators and airlines on the system.

But as of Tuesday night, the company still had not filed a formal certification request to the US Federal Aviation Administration, a source said.

After submitting the request, the next step will be to conduct a certification flight with the US Federal Aviation Administration, and then the company will need to win approval from international regulators, Muilenburg said.

Boeing is hoping to finalize regulatory approval by the end of May for its fix and to have the planes cleared to fly in July, according to a source familiar with the situation.

Despite the crisis, many analysts are optimistic about Boeing's long-term prospects, given robust global aerospace demand. They expect Boeing will be successful in addressing the 737 MAX's problems allowing the plane to return to service and continue to command the interest of airlines.

However, some caution that Boeing's reputation has been damaged by the crisis that could deteriorate further with any additional missteps.

Boeing shares rose 0.4 percent to close the day at $375.46.

© 2019 AFP