Crowdfunding expands innovation financing to underserved regions

Crowdfunding platforms, such as Kickstarter, have opened a funding spigot to startups in regions that have suffered from a venture capital drought, a new UC Berkeley study shows.

Historically, funding for innovation has come from venture capitalists, which tend to fund entrepreneurs that often mirror the investors in terms of their educational, social and professional characteristics. Venture capital funding also tends to be concentrated in a small number of regions, such as Silicon Valley. The study found that crowdfunding has spread startup financing beyond these entrepreneurial bubbles.

"Most venture capital gets invested in Silicon Valley and Boston, and thus shortchanges the rest of the country for entrepreneurial financing," said study senior author Lee Fleming, faculty director of the Coleman Fung Institute for Engineering Leadership at UC Berkeley. "But crowdfunding has opened up funding to everyone else."

The article was published in a recent edition of the journal Science.

For the study, researchers analyzed data from 2009 to 2015 on successful Kickstarter campaigns and venture capital investments. Because some Kickstarter campaigns are for projects that have no real possibility of being backed by venture capitalists, such as the creation of artwork, and because venture capitalists may invest in some kinds of companies, such as biotechnology, that fall outside the scope of the Kickstarter platform, the researchers compared investments that could have reasonably been funded by either crowdfunding or venture capital.

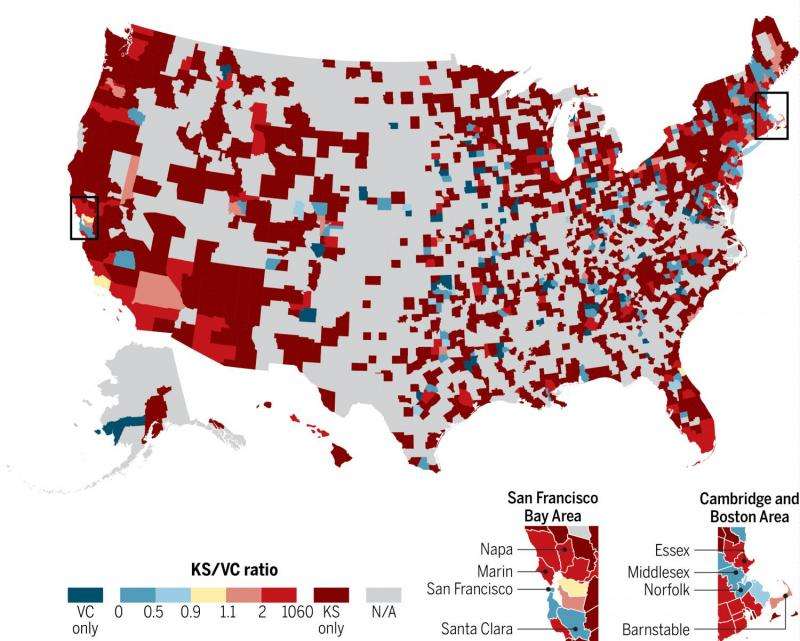

The researchers identified 55,005 Kickstarter projects in categories similar to the industries in which venture capitalists invested, and 17,493 venture capital investments in industries engaged in activities similar to those of Kickstarter campaigns. The researchers then used this dataset to map Kickstarter projects and venture capital investments by county and by year.

Although the typical Kickstarter campaign involved a smaller amount of money, these campaigns covered a broader swath of the nation, the analysis found. Several places with the largest number of successful Kickstarter campaigns have not been magnets for venture capitalists' investments, such as Chicago, Los Angeles and Seattle.

Venture capitalists' investments were highly concentrated, the analysis found. Just four counties, located in the Boston area and Silicon Valley, account for 50 percent of all matched venture capital investments, according to the data set.

To adjust for differences in population and other factors that might produce more investments in all types of innovative activity in some places, the researchers calculated the relative intensity of Kickstarter versus venture capital dollars in each region. They found that Kickstarter allocates a much larger share of its resources than venture capitalists to the interior of the country, away from coastal population centers and traditional technology hubs. Even in the Boston area and Silicon Valley, Kickstarter investments were concentrated in different areas than venture capitalists' funding. Kickstarter funding in the Bay Area, for example, goes disproportionately to Marin and Napa counties, whereas San Francisco and the Peninsula counties received more venture capitalists' funding.

The study found that crowdfunding in a region, and in particular successful technology campaigns, appeared to cause an increase in venture capital funding in the region. This occurs as venture capitalists look for promising new ideas and a successful campaign is a very good indicator of potential.

"This effect has gotten consistently stronger over the last six years," Fleming said. "If this phenomenon continues, crowdfunding could begin to address regional inequality in entrepreneurial financing, through both direct crowdfunding investment and induced venture capital investment."

More information: Olav Sorenson et al. Expand innovation finance via crowdfunding, Science (2016). DOI: 10.1126/science.aaf6989

Journal information: Science

Provided by University of California - Berkeley