Facebook IPO to bring cash and change

Facebook makes its hotly anticipated stock market debut this week in a history-making move promising wealth for insiders and change for users of the online social network.

Hot interest in Facebook stock reportedly prompted the company to bump the opening price range to $34 to $38 for its shares, which would value the firm at between $93 billion and $104 billion.

The Menlo Park, California-company will nail down the initial public offering (IPO) share price before it begins trading as a public company.

The IPO is expected to happen Friday although the timetable has not been confirmed.

Facebook watchers said users of the social network should expect changes -- though not overnight.

"The only reason a company goes public is to raise cash to expand," said Creative Strategies principal analyst Tim Bajarin.

"So, the general public at least knows the IPO means Facebook will be able to do more things.

"Facebook is not extremely specific on what they will do with the money; they say they want to be creative, expand, and do new things."

Facebook will keep the lion's share of the potentially $14.7 billion raised by selling stock. The rest of the cash is to stuff pockets of company founders and investors including rock star Bono.

Mark Zuckerberg, who founded Facebook eight years ago from his Harvard dorm room, will retain 57.3 percent of the voting power of the shares and the IPO was structured to allow him to retain a firm grip on the company.

"He really wants to create an open social network," Bajarin said of Zuckerberg, who turned 28 on Monday. "One that allows Facebook to get more aggressive in the way they connect and provide services to people."

Some analysts predicted Facebook's stock price will jump quickly to $44 a share and climb much higher in the long term.

At the heart of the debate about the wisdom of owning a piece of Facebook is how much revenue it takes in.

Revenue vaulted to $1.06 billion in the quarter which ended March 31 -- an improvement year-over-year, but down about six percent from the previous quarter. Eighty-five percent of the total came from ad sales.

As one analyst noted, however, Facebook only bills a scant half-percent of the $600 billion spent each year on all kinds of advertising -- even though at least one of every seven minutes spent online around the world is at Facebook.

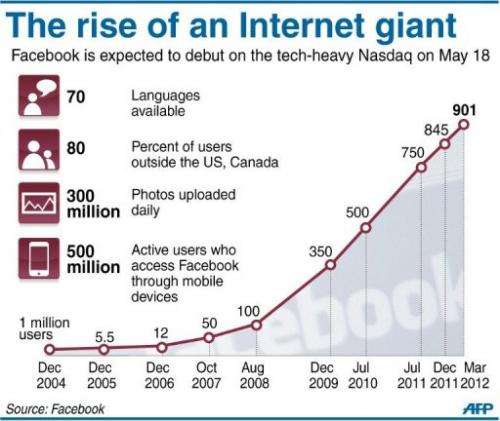

There is wide margin for improvement, seeing as Facebook has more than 900 million users and membership is expanding.

The leading social network is unabashedly working to follow members onto smartphones and tablet computers, and the IPO windfall would provide plenty of cash to partner with a hardware maker on a long-rumored "Facebook phone."

Morningstar analysts concluded that optimism regarding Facebook's prospects was warranted and considered its popularity on mobile devices "impressive."

"Although the company has not actively developed its mobile advertising capabilities, we expect a substantial bulk of mobile advertising dollars to flow to Facebook within the next couple of years," Morningstar said.

Recent Facebook moves have included letting people store digital files in the Internet "cloud" and allowing Microsoft to weave social network feedback into results of Bing-powered searches.

"We've rarely seen a company borrow from its competition as quickly or as well as Facebook," Forrester analysts Nate Elliott and Melissa Parrish said in a blog post on Monday. "And that focus on better serving end users has seen Facebook grow quickly over the years, even in the face of consistent privacy concerns.

"But as good as Facebook has been at evolving to serve consumers, that's how bad it's been at serving marketers."

Facebook has "lurched" from one advertising model to another during the past five years, according to the analysts.

A report over the weekend indicated that Facebook was dabbling with a scheme where advertisers would pay to promote posts at the service in a manner similar to a Twitter model of charging to give "tweets" high profiles.

"We wish we could predict this IPO would serve as a new beginning for Facebook's marketing offering, and that a new focus on becoming a grown-up business would inspire the company to put even half the energy into serving advertisers that it does into serving users," Elliott and Parrish said.

"But we doubt Zuckerberg's going to wake up any day soon having acquired a taste for advertising, or even a proper understanding of it."

Still, there will be no shortage of people snapping up Facebook shares. Even Apple co-founder Steve Wozniak has gone public saying he plans to invest.

Facts and figures about Facebook

Facts and figures about Facebook, which priced its initial public offering:

- Facebook has more than 900 million active users. If the company were a country, it would be the third largest in the world after China (population: 1.34 billion) and India (population: 1.17 billion).

- Some 488 million people use Facebook on mobile devices. That is more than half of its members worldwide, and the reach is even bigger in countries such as South Africa, Nigeria and Japan, where mobile use is 70 to 90 percent. (source: socialbakers.com).

- With 157 million members, the United States has the most Facebook users. Brazil recently jumped to second place with 47 million, followed by India with 45.8 million, Indonesia with 42.2 million and Mexico with 33.1 million. (source: socialbakers.com)

- Facebook is the most popular social network in every country of the world, with the exceptions of China, Japan, Russia, South Korea and Vietnam. (source: comScore)

- In April, Facebook announced a billion-dollar deal to buy the startup behind wildly popular smartphone photo sharing application Instagram, its biggest acquisition to date. The US Federal Trade Commission is reviewing the deal.

- Facebook has minted four billionaires: Mark Zuckerberg, Dustin Moskovitz, Eduardo Saverin and Sean Parker. The 27-year-old Zuckerberg's net worth was estimated at $17.5 billion on the 2011 Forbes list of the wealthiest Americans. Moskovitz had a net worth of $3.5 billion but pipped Zuckerberg for the title of world's youngest billionaire, being eight days younger. The Brazilian-born Saverin, who left Facebook early on after a falling-out with Zuckerberg, had a net worth of $2 billion. Parker, the Napster co-founder who briefly served as Facebook's president, had a net worth of $2.1 billion.

- Chris Hughes, one of Facebook's four co-founders, served as director of online organizing for Barack Obama's successful 2008 presidential campaign.

- Facebook says it had an average of 526 million daily active users in March 2012, an increase of 41 percent from a year ago. It had registered 125 billion "friend connections" as of March 31 and 3.2 billion "likes" and comments.

- More than 300 million photos are uploaded to Facebook every day and more than 488 million active users access Facebook using mobile devices.

- "The Social Network," the 2010 film about the origins of Facebook, won four Golden Globes -- including for best picture and best director -- but flopped at the Oscars, walking away with only awards for best adapted screenplay, original score and film editing.

- Facebook, which currently employs some 3,500 people, has announced plans to hire "thousands" more over the next year. Some studies suggest that Facebook-related firms and apps have created many more jobs and economic value.

(c) 2012 AFP