New index measures financial stability

(PhysOrg.com) -- What does it take for a family in the U.S. to have long-term economic security and not just "get by"? This question inspired the creation of the Basic Economic Security Tables Index (BEST), a joint effort of Wider Opportunities for Women (WOW) and the Center for Social Development (CSD) at the Brown School at Washington University in St. Louis.

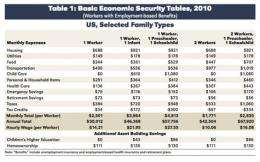

The national BEST Index provides a broad view of the state of the nation’s workers—the expenses they face, their resources and their prospects for achieving financial stability.

View the tables and complete report at csd.wustl.edu/Publications/Documents/RP11-09.pdf .

“The BEST follows a long history of research defining families’ spending and income needs, but reflects a modern economy and contemporary understanding of how families achieve financial stability,” says Yunju Nam, PhD, assistant professor at the School of Social Work at the State University of New York at Buffalo and faculty associate at CSD.

The BEST is different from other ‘living wage’ indexes in that it aims to capture what is needed for household stability and development rather than focusing on subsistence.

Findings suggest that families’ largest economic security challenges are rent and utilities, transportation, and childcare.

The report calls the high cost of quality childcare “the greatest threat to many families’ security.” Childcare is so expensive that income needs for a one-parent family with two preschoolers are equivalent to those of a one-parent family with five teenagers.

The BEST includes saving components such as emergency savings, retirement savings, education savings and homeownership savings that are essential for long-term economic security and household development.

Sufficient emergency savings are a small part of most BEST budgets (3%-4%) but are much higher for those who lack access to unemployment insurance. Retirement savings of $73 per month per worker or $56 per couple greatly increases the chances of aging in the home and maintaining basic economic security in retirement.

"Meeting basic monthly living expenses alone leaves a family short of genuine financial stability,” notes Nam. “Workers must develop assets to attain both short-term and lifelong economic security. The BEST therefore suggests how much workers should save to reach modest asset development goals.”

The index is intended for use by policymakers, researchers, and policy advocates concerned with national policy needs and with changes in workers’ and families’ needs over time. The savings components incorporated in the BEST suggest the importance of asset building for household development and stability.

“In order for families to develop,” notes CSD Director Michael Sherraden, PhD, the Benjamin E. Youngdahl Professor of Social Development at Washington University in St. Louis.

“It is necessary to accumulate savings and assets for investments in homes, education, experience, and enterprise. This is true for all families, rich and poor alike. Asset holding creates material conditions, as well as outlooks and behaviors, that promote household stability and development.”

CSD’s work on the BEST is part of the Washington University’s Livable Lives Initiative, which investigates social conditions and policy supports that can help make life with a low or moderate income stable, secure, satisfying, and successful.

WOW organized and led the development of the BEST, and CSD provided expertise on the saving components. WOW works nationally and in its home community of Washington, DC, to achieve economic independence and equality of opportunity for women and their families at all stages of life. CSD is a leading academic center for theory and research on asset-building strategies for low-income individuals and families.

Provided by Washington University in St. Louis