December 4, 2014 report

New study suggests US fracking boom may not last as long as predicted

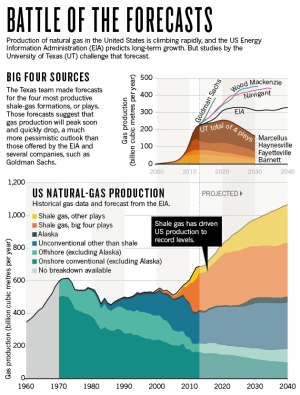

(Phys.org)—A team of researchers with the University of Texas has conducted an analysis of the fracking business in the United States and has found that the estimates made by other groups, most specifically the Energy Information Administration (EIA) regarding the amount of natural gas that can be extracted, is much too high. In a Nature News Feature, team lead Mason Inman suggests that the boom may last just half as long as predicted.

Just half a decade ago geological experts with the government and in private industry were bemoaning the sad state of U.S. energy production. Gas prices were high causing the government to invest funds in renewable resources, but then, suddenly, hydraulic fracturing, now known the world over as fracking took off, offering industry and consumers a seemingly unending energy source. President Obama boasted that fracking would provide the U.S. and other countries with natural gas for a hundred years. That boast was slightly tempered when the EIA suggested that peak production would likely last up till 2040, and then taper off after that. Now, the Texas team is suggesting that even that estimate is too optimistic—they suggest the peak will likely come in 2020, and after that production will fall off dramatically.

The estimates differ, Inman says, because of differing approaches used to arrive at estimates. The Texas team used finer resolution he says, which offers a more realistic view of where we stand. As an example, he notes that the EIA made estimates based on county wide production in a given area, whereas the Texas team divided areas into one square mile units. Basing estimates on counties, he says, isn't fine enough because county size varies so much, with some as large as a thousand square kilometers. He and his team believe that the EIA also erred by overlooking human nature in the equation. Mining companies tend to look for the sweet spots, which is where production will be highest, he notes—once the sweet spots are depleted, production drops dramatically because there is less gas to be found, which means adding more costs to retrieve it.

Inman also claims that several other smaller university based studies have found the EIA's estimates to be overly optimistic as well. He notes that it's critical that true estimates be made, as the future U.S. economy is being based on investments in natural gas—not getting it right could very well spell disaster.

More information: Natural gas: The fracking fallacy, Nature 516, 28–30 (04 December 2014) www.nature.com/news/natural-ga … king-fallacy-1.16430

Journal information: Nature

© 2014 Phys.org