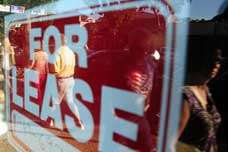

Cities can't bank on small businesses for stable economic partnerships

(PhysOrg.com) -- Locally owned small businesses don't insulate communities from layoffs and closures in bad economic times. Rather, corporate headquarters do the most to protect cities from employment reductions, reports a new study co-authored by a UC Irvine economist.

This debunks a popular argument that owners of "mom and pop" stores are less likely to lay off employees, relocate or close their businesses when the economy sours, said David Neumark, UCI economics professor and a Bren Fellow at the Public Policy Institute of California. The findings validate the efforts of many local governments to attract and retain corporate headquarters, he said.

"People may prefer funky coffee shops downtown, but corporate headquarters and in some cases small chains may provide more stable jobs to the community," Neumark said. The study, co-authored by Jed Kolko, associate director and research fellow at the institute, was published online recently in the Journal of Urban Economics.

Using a national database, researchers examined business patterns over 14 years. Businesses were classified as standalone, parts of larger companies (such as chain restaurants and factories), or corporate headquarters.

Two types of economic shocks were identified: those affecting many industries in a particular region and nationwide jolts specific to an industry. Researchers measured how the businesses adjusted their employment levels in response to the shocks. They then looked at how responses varied among the different kinds of businesses.

The result: Corporate offices were the most stable in terms of avoiding layoffs and closures, and smaller, locally owned chains provided some stability. In contrast, job losses caused by industry downturns were 60 percent greater for standalone businesses than for stores or factories reporting to headquarters in another city. Cuts were half as large at corporate headquarters as at non-locally owned stores or factories.

The study was funded by a grant from the David A. Coulter Family Foundation to the Public Policy Institute of California. Read the full report here: www.economics.uci.edu/~dneumar … _ownership_final.pdf

Provided by UC Irvine