This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Nonprofits with investment income slower to recover from economic downturns, study shows

A recent study evaluates three decades of financial data from nonprofit organizations and finds that while the sector tends to bounce back quickly after periods of economic recession, some organizations bounce back more quickly than others. Specifically, the researchers found that nonprofits that rely on investment income to fund operations are often less resilient in the face of economic downturns.

The paper, "True Grit: Exploring Nonprofit Sector Resilience Following Economic Recessions," is published in the journal Nonprofit Policy Forum.

"Nonprofit organizations have a reputation in academic circles for being 'resilient," meaning that they persist even during uncertain times," says Amanda Stewart, corresponding author of a paper on the work and an associate professor of public administration at North Carolina State University. "We wanted to look at the economic data to see if that's actually true and—if so—why."

"Nonprofits often operate on extremely tight budgets, and rarely have robust financial resources set aside for a rainy day," says Kerry Kuenzi, co-author of the study and a professor of public affairs at the University of Wisconsin-Green Bay. "What—if anything—equips nonprofits to maintain their performance following adverse events like a recession? Our findings have ramifications for both policymakers and nonprofits."

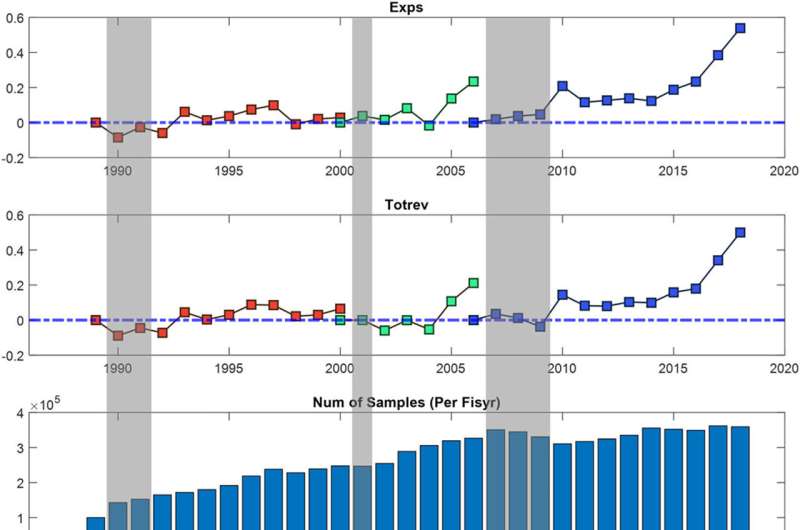

For the study, researchers evaluated tax return data from more than 500,000 nonprofit organizations in the U.S., spanning the years 1989 to 2018. Specifically, the researchers looked at both sources and amount of revenue, as well as each organization's expenditures—which serves as a proxy for a nonprofit's ability to provide services.

"Revenues and expenditures take a dip during recessions," says Xintong Chen, first author of the study and an assistant professor of public administration at San Jose State University. "We looked at how quickly each nonprofit's revenues and expenditures returned to prerecession levels once the recession ended. If an organization was able to quickly return to prerecession performance levels, that tells us the organization is resilient."

Between 1989 and 2018 there were three major economic recessions: July 1990–March 1991, March 2001–November 2001, and December 2007–June 2009.

"Broadly speaking, we found that the trend across the nonprofit sector was to recover fairly quickly after economic recessions," Stewart says. "However, we found significant variability within the sector."

Unsurprisingly, larger nonprofits tend to bounce back the fastest. But the researchers found that an organization's sources of revenue also played an important role.

Nonprofits essentially have four streams of revenue: earned income, in which clients pay the nonprofit for services; contributions from donors; grants from state, federal and local governments; and revenue from investments.

"We found that nonprofits which depended more on investment revenue—such as many nonprofits with large endowments—bounced back more slowly than other organizations in the wake of a recession," Chen says.

"It's difficult for organizations to change their revenue structures, but our findings suggest that nonprofits that rely extensively on investments to fund operations may want to consider developing plans for how they could bounce back more quickly in the event of future economic downturns."

"From a policy standpoint, our findings also suggest that government decisionmakers may want to be prepared to provide greater assistance to nonprofits that rely more heavily on investments," says Stewart.

"This research is an important contribution to the field of nonprofit studies because we are capturing 29 years' worth of data from across the U.S.," Stewart says. "That gives us a broad, longitudinal perspective that is rare when it comes to assessing the financial health of nonprofits.

"Many studies focus on specific disasters or geographic regions, and COVID has driven home the fact that some disasters are long-lasting and nationwide or international in scope. By using economic recessions as examples of nationwide disasters, we're optimistic that our approach here can serve as a blueprint for future work."

The paper was co-authored by Lindsey Evans, an assistant professor of government and public affairs at Virginia Commonwealth University.

More information: Xintong Chen et al, True Grit: Exploring Nonprofit Sector Resilience Following Economic Recessions, Nonprofit Policy Forum (2024). DOI: 10.1515/npf-2023-0058

Provided by North Carolina State University