This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

reputable news agency

proofread

Can a $20 billion bet wean Indonesia off coal?

Less than a year after it was announced, a $20 billion bet to wean Indonesia off coal is mired in controversies over financing and the construction of new plants to power industry.

The Just Energy Transition Partnership (JETP) for Indonesia was unveiled last November, as the country hosted the G20 summit in Bali.

It follows a model first trialed in South Africa, and subsequently announced for Vietnam and Senegal, with rich countries pledging funds for the developing world's energy transition.

The basic premise is simple: public and private financing of up to $20 billion, in exchange for Indonesia peaking power sector emissions by 2030 and reaching net-zero power sector emissions by 2050.

That brings forward Jakarta's previous pledges and would see one of the world's top coal exporters and coal power generators weaning itself from the polluting fossil fuel.

But after the initial fanfare has come the much tougher business of plotting a path to those goals.

In August, Jakarta postponed the release of its JETP roadmap, in part over problems calculating its expected emissions.

Indonesia's JETP assumes the power sector was on track to emit 357 million tons of carbon by 2030, and will now limit that to a peak of 290 million tons.

But those figures failed to account for a number of new "captive" coal plants, which power factories rather than feeding into the grid.

So, "the question arises: can the target of 290 million tons still be achieved," asked Fabby Tumiwa, executive director of the Institute for Essential Services Reform (IESR), an Indonesian energy think tank.

"And is the commitment of $20 billion... adequate to achieve that target?"

The JETP secretariat did not respond to a request for comment.

'Not the way to do it'

Jakarta is reportedly also unhappy about the deal's proposed mix of financing, worried it will be offered mostly market-rate loans that saddle it with debt.

"Indonesia is hoping for a larger share of grants," said Anissa Suharsono, energy policy associate at the International Institute for Sustainable Development.

She pointed to a Bloomberg report suggesting Indonesia could expect just $289 million in grants, with half earmarked for technical assistance.

"That is, in my view, outrageous. If it's meant to be a climate fund to encourage a developing country to faster transition, then this is not the way to do it," Suharsono told AFP.

The scale of the funding is another sticking point.

The JETP is not intended to cover all transition costs, with backers saying it should encourage other investors.

But estimates for the cost of achieving Indonesia's pledged goals are upwards of $100 billion, Tumiwa said, and that figure could be higher given the emissions miscalculation.

Even if an agreement on the financing mix can be hammered out, there are other stumbling blocks.

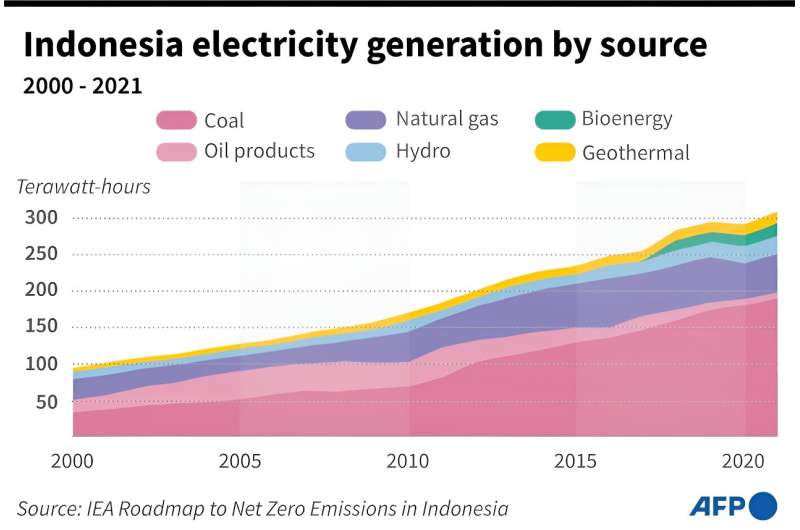

Indonesia, which generates over 60 percent of its power from coal, has many more coal plants than South Africa—one of the world's largest emitters of greenhouse gases, and they are much younger.

That makes them more expensive to retire, with many more years of potential returns on investment to compensate when shuttering them.

'Nothing is perfect'

Solar and wind power account for less than one percent each of Indonesia's current power mix, and the archipelago's grid is both decentralized and needs upgrading to handle the intermittent nature of renewable energy.

The appetite for financing those upgrades may be low because state-owned Perusahaan Listrik Negara, commonly known by its acronym PLN, has a monopoly on the power sector, added Suharsono.

"Who's going to invest money in a grid that is going to belong to someone else?"

Experts also warn Indonesia needs to prepare for the economic impact of shifting from coal, an industry that directly employs around 250,000 people, according to IESR.

"The coal regions like in Kalimantan and south Sumatra, they are very reliant on the income from coal extractions and economic activities created from these coal extractions," said Rezky Khairun Zain, climate and energy senior analyst at the World Resources Institute, Indonesia.

"The government needs to set up capacity building not only for the workers but also the (local) governments, for them to find another way to increase the income not from the coal activities," he told AFP.

For all the challenges, Tumiwa believes the program is the best option on the table.

"Nothing is perfect. The funding is still insufficient, and the negotiations are still challenging," he said.

"But we must proceed, at least to demonstrate that this concept can work and serve as a model."

© 2023 AFP