This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Researcher investigates left-tail momentum in the Korean stock market

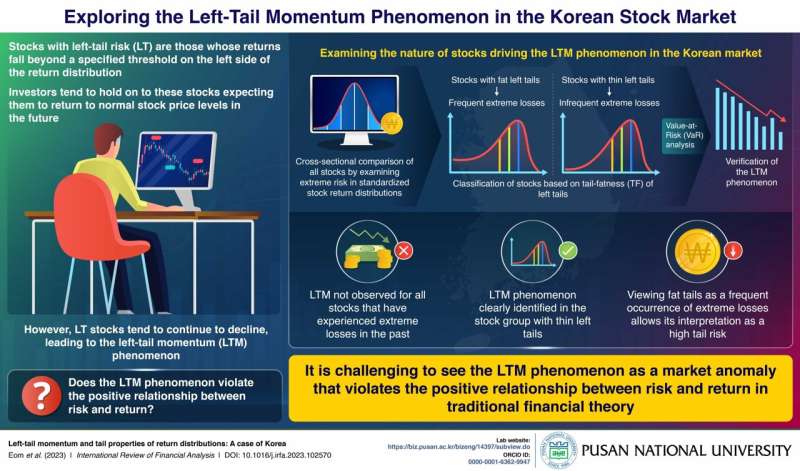

Left-tail risk (LT) stocks are those whose returns fall into the extreme end on the left side of the return distribution. In the hopes of mean-reverting to the normal price, investors usually hold on to these stocks. However, contrary to mean-reverting expectations, these stocks that have experienced extreme losses and high tail risks in the past tend to continue declining in the future, resulting in financial losses.

This phenomenon, referred to as left-tail momentum (LTM), appears to challenge the traditional notion of a positive relationship between risk and return.

To investigate this market anomaly, a team of researchers, led by Prof. Eom from the School of Business at Pusan National University in South Korea, have recently re-verified the LTM phenomenon in the Korean stock markets through a cross-sectional comparison of all stocks by examining extreme risk situations.

Their work was published in the International Review of Financial Analysis.

The researchers analyzed stock returns from July 2000 to June 2021 and standardized the distributions of these returns to cross-sectionally compare all stocks in the same criterion. By aligning the returns of all stocks within a predetermined threshold, they established a fair basis for comparing risks across different stocks. Their analysis revealed two types of LT stocks: those with fatter tails, reflecting higher tail risk and more frequent extreme losses, and those with thin tails, indicating relatively low tail risk and infrequent extreme losses.

The researchers then proceeded to investigate the LTM phenomenon within these groups by utilizing a measure called Value-at-Risk (VaR), which represents the boundary value associated with a specific probability in the distribution of stock returns. By utilizing VaR, they were able to assess the magnitude of potential financial losses, taking into consideration the tail-fatness property of the stock return distributions.

They found that the LTM phenomenon is not observed for all stocks that have experienced extreme losses in the past, but rather only for stocks with thin tails—stocks that have lower tail risk and have experienced extreme losses infrequently in the past. These results challenge previous assumptions, demonstrating that the LTM phenomenon does not contradict the conventional positive relationship between risk and return.

"If the fat tail property is viewed as a frequent occurrence of extreme losses, it can be interpreted as a high tail risk. Since LTM phenomenon was clearly observed only in stocks with a thin tail distribution, it is difficult to see it as evidence that violates the positive relationship between risk and return in traditional financial theory," emphasize the researchers.

Overall, the research reveals that the LTM phenomenon is driven by investors overvaluing stocks with low left-tail risks compared to those with high left-tail risks. "This study looks forward to an interesting discourse in further studies investigating whether the LTM phenomenon that involves a low left-tail risk can be explained in terms of the risk–return trade-off relationship," conclude the researchers.

More information: Cheoljun Eom et al, Left-tail momentum and tail properties of return distributions: A case of Korea, International Review of Financial Analysis (2023). DOI: 10.1016/j.irfa.2023.102570

Provided by Pusan National University