This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

proofread

The spillover effects of rising energy prices following 2022 Russian invasion of Ukraine

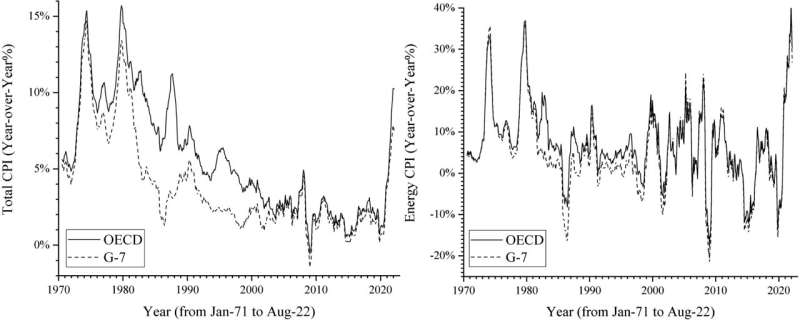

Following the Russian invasion of Ukraine from February 24, 2022, energy prices rose by up to 20% worldwide for five months. WTI crude oil was $92.77 per barrel on February 24, 2022, but rose and averaged $106.96 (+15.3%) from February 28 to August 3.

Furthermore, energy consumer price indexes (energy CPI) increased consecutively for five months, when comparing February and July, in OECD (18.0%) and G-7 (18.9%) countries, hitting their highest year-over-year growths ever since tracking began in 1971 in OECD (40.70%) and G-7 (39.43%) in June 2022.

Because energy use is merely an intermediate input, rising energy prices may have little impact on real gross domestic product (GDP). Meanwhile, rising energy prices may decrease social surplus, slowing economic growth.

When energy prices rise, consumers primarily buy less durable goods, e.g., cars and new houses, and firms may reduce their investment spending due to uncertainty. Also, because fossil fuels are primarily used as intermediate inputs upstream in the supply chain, higher energy prices lead to higher global costs (due to spillover effects).

For such a shock analysis, input-output analysis (IOA) is favored to examine the spillover effects in the supply chain. In particular, the Leontief quantity model—the most popular demand-driven model—is the de-facto standard for both demand and supply analysis. However, it has issues. The model is not theoretically consistent with the supply analysis, and, more importantly, it is likely to overestimate monetary damage because price and quantity are inelastic.

A new study from researchers at Kyushu University finds that if the price increases by 20% in Russia's mining and quarrying (M&Q) sector alone, there will be almost no effects globally. That is, global prices will rise by only 0.13% across all sectors globally (weighted average), reducing social surplus by 0.28% of the pre-invasion monthly GDP ($22,295 million per month).

Meanwhile, if prices increased by 20% globally in every M&Q sector, global prices will rise by 3.15% across all sectors, reducing the social surplus by 6.83% of the pre-invasion monthly GDP ($551,080 million per month). This case is roughly equivalent to Russian M&Q (energy) prices being five times higher (+497%), demonstrating the magnitude of geopolitical risk.

Research Lecturer Michiyuki Yagi and Professor Shunsuke Managi in the Urban Institute and the Department of Civil Engineering, Kyushu University, reached these conclusions by updating the world IO table to 2021 values (56 sectors in 44 countries) and analyzing the two scenarios above using the Leontief price model with the exogenous price elasticity of demand at the monthly level, a method developed by the authors and published in Risk Analysis in 2020. As advantages, this model is theoretically suitable for supply analysis and will not overestimate monetary damages because price and quantity are perfectly elastic to each other.

Regarding the policy implications, with a price change of only 20%, Russia's energy sector alone has little global impact because the economic scale is relatively small. Second, if energy prices rise globally, the most affected are three energy-related sectors (M&Q, coke/petroleum, and electricity and gas supply), metal, mineral products, electrical equipment, chemical products (manufacturers), air transport, and construction (service sectors).

Finally, if energy prices rise, policymakers should focus on the downstream sectors of buyers or consumers. They will be more damaged than sellers or producers as they have to buy fewer quantities at higher prices. In terms of energy (fossil fuel) prices, the 2022 Russian invasion of Ukraine (was an economic shock that) cost consumers or buyers (in the world) primarily 2.85% of the pre-invasion annual GDP ($2.7 trillion) in five months following the invasion.

The results of this research was published online in the journal Economic Analysis and Policy.

More information: Michiyuki Yagi et al, The spillover effects of rising energy prices following 2022 Russian invasion of Ukraine, Economic Analysis and Policy (2022). DOI: 10.1016/j.eap.2022.12.025

Michiyuki Yagi et al, Supply Constraint from Earthquakes in Japan in Input–Output Analysis, Risk Analysis (2020). DOI: 10.1111/risa.13525

Journal information: Risk Analysis

Provided by Kyushu University