Mexican immigrants have to work longer due to inadequate Social Security benefits, study finds

Mexican immigrants are a critical part of the American workforce, but they are also financially vulnerable.

As Emma Aguila explains in new research she co-authored in the Journal of Pension Economics and Finance, Mexican immigrants face greater obstacles in securing social security benefits and therefore have to work later into life.

Equally important, Aguila and her colleagues, Zeewan Lee and Rebeca Wong, found Mexicans who do receive those benefits are more likely to rely on them compared to non-Hispanic white populations.

However, an existing framework that determines benefits based on the number of years a worker contributes to U.S. social security could help alleviate the problem if it were applied to Mexico.

Lacking access to social security

Mexican immigrants in the United States have a complex journey to retirement. Because they are working in the U.S., they do not earn social security benefits in Mexico. However, those who are undocumented in U.S. are also not receiving American social security. While documented immigrants qualify for social security, undocumented ones do not. This is despite the fact that the Social Security Administration estimates three-quarters of undocumented immigrants pay payroll taxes, resulting in roughly $6–$7 billion in social security contributions which they cannot claim.

The research focused largely on the "determinants," or triggers, that would enable someone to retire. Examples include social security benefits, health and income.

One determinant Mexican workers reacted strongly to was social security benefits and pensions, if they were available.

"The social security benefits that comprise most retirement income for Mexican-born immigrants had a far greater effect on retirement decisions than did other sociodemographic, health or institutional influences," the research states.

For example, the researchers found that a $10,000 increase in social security wealth increased the probability of retirement for non-Hispanic whites by 0.5 percentage points, but increased the same figure by 0.9 percentage points for Mexican-born immigrants.

A longer career, but not by choice

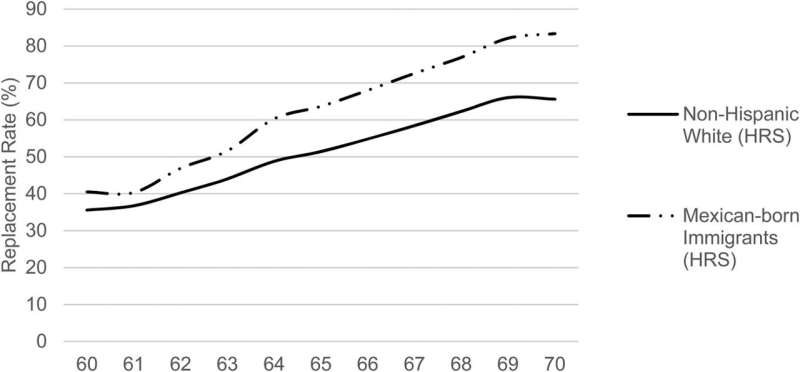

The researchers analyzed two data sets: one survey from the U.S. and one from Mexico. They found that Mexican-origin workers in the U.S. were more likely to work longer than non-Hispanic white workers.

"Some of them send their savings to Mexico when they were working in the U.S. They don't have any sources of income or savings in retirement, so they have to continue working," said Aguila, who is an associate professor at USC Price.

The average retirement age in the U.S. is 62, according to Gallup. In Mexico, it is 65, according to the Organization for Economic Cooperation and Development.

According to the research, because Mexican-origin workers rely heavily on whatever social security benefits they might receive—either from Mexico or the U.S.—changes to that system will significantly affect the length of their careers.

"Given the impact of social security wealth in our analyses, we expect future changes in the U.S. social security system will strongly affect labor force participation and retirement decisions of Mexican-born immigrants," the researchers say.

Some promising policy changes could come in the form of totalization agreements, which enable immigrants who work in one country for at least five years to receive its retirement benefits, even if they are not citizens. Pension or social security benefits are determined by the numbers years during which a person contributes.

Currently, the U.S. has totalization agreements with about 30 countries, according to the Social Security Administration. Mexico is not one of them.

"Instituting such an agreement," the research states, "would enable Mexican-born immigrants and return-migrants to more readily access social security benefits and to improve their well-being in retirement."

More information: Emma Aguila et al, Migration, work, and retirement: the case of Mexican-origin populations, Journal of Pension Economics and Finance (2021). DOI: 10.1017/S1474747221000342

Provided by University of Southern California