Canada's farmland is a wise investment—during and after the coronavirus

COVID-19 has put the world's economies on pace for the most dramatic contraction since the Great Depression. With the world's major economies on track for the largest quarterly decline in history, Canadian farmland is an increasingly stable and resilient investment.

Canada is one of the largest agricultural producers and exporters in the world. According to Statistics Canada, the country is the fifth-largest agricultural exporter.

Agriculture is one of Canada's largest industries, directly employing nearly 300,000 people, and it accounts for roughly five percent of the country's gross domestic product. As the world's population grows, Canadian agriculture and related industries will grow in size and importance.

Population growth

Today, there are more than seven billion people in the world. It is estimated that by the year 2050, there will be more than nine billion people.

It's also been predicted that 90 percent of existing arable land will be used to produce as much as 70 percent more food to accommodate this growth. This will invariably raise the value of global farmland.

Simple economics suggest that if demand increases while holding supply constant, prices will rise. That means increased demand for food and constraints on arable land will lead to appreciating farmland values.

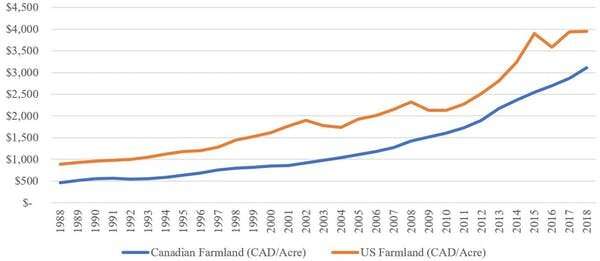

Over a 30-year period of significant population growth, the value of farmland in both Canada and the United States grew steadily. See below:

According to Statistics Canada, the average price of farmland per acre in 1988 was $464. At the same time, according to the U.S. Department of Agriculture, American farmland was the equivalent of C$885 per acre. In 2018, the average of farmland per acre in Canada exceeded $3,000, and in the U.S., it exceeded $4,000. Based on this historical data and the future outlook, investment in farmland is promising.

A looming Saskatchewan boom

My experience as a senior manager of an agriculture company for the better part of a decade gave me perspective of the unique value of Saskatchewan agriculture. Farmland appreciation in the Canadian Prairies, where agriculture is a core economic driver, has shown greater increases than other areas of the country.

According to the Saskatchewan government, the province "is home to more than 40 percent of Canada's cultivated farmland, some of the most productive land in the world."

Saskatchewan farmland ownership has been more restricted than other provinces, resulting in a historically lower price per acre. Given the high soil quality and relaxation of purchase provisions over the past decade, the price per acre in Saskatchewan is on the rise. That means forthcoming investments are likely to provide fruitful returns and capital appreciation.

Based on Farm Credit Canada's 2018 and 2019 reports, the three-year average increase in Saskatchewan farmland values was 6.2 percent compared to 4.9 percent in British Columbia, 3.3 percent in Alberta and 4.2 percent in Manitoba.

Some of the largest Saskatchewan farmland owners, including Andjelic Land Inc., Avenue Living Agricultural Land Trust and the Heide family have benefited from farmland appreciations via their strategic investments.

Investment comparison

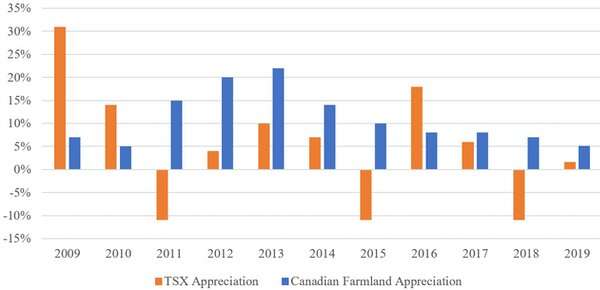

Comparing farmland to the appreciation of Canada's primary stock exchange, the Toronto Stock Exchange (TSX), over an 11-year period from 2009 to 2019 shows the consistency and stability of farmland over stocks.

Despite two economic downturns, farmland showed positive appreciation year-over-year compared to the more volatile TSX.

Even though the TSX showed more than 30 percent appreciation in 2009, three of the those years produced depreciations exceeding 10 percent. Conversely, farmland consistently appreciated, ranging from five percent to more than 20 percent, throughout the same 11-year period.

Given the expected global population growth, food demand and current arable land constraints, farmland investments will likely continue to yield lucrative returns.

Farmland in Canada and the U.S. has historically appreciated as population and global food demand has increased. Farmland has also served as a value-add to portfolios and has proven to be more predictable with respect to its appreciation than equity markets.

Further opportunity for investment in farmland remains, with substantial value to be extracted. Specifically, regions of Canada like Saskatchewan have been historically undervalued and as a result, are appreciating.

As such, there is a compelling opportunity for profit. Due to long-term projections, now more than ever it is strategic to incorporate farmland into investment equations. To quote Mark Twain: "Buy land, they're not making it anymore."

Provided by The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.![]()