New paper examines the details behind stock market 'flash crash'

A paper by UC Santa Cruz professors of economics and astrophysics has attracted widespread attention in the financial world over its analysis of the "flash crash" nearly six years ago that saw the Dow Jones Industrial Average plunge 1,000 points in less than five minutes.

"The Flash Crash: A New Deconstruction" by Eric Aldrich, assistant professor of economics, and Greg Laughlin, professor of astronomy and astrophysics, along with a colleague at Stanford University Law School, looks at the practice of high-frequency computerized trading. Specifically, they take a granular-level investigation of the trades leading up to the May 6, 2010 crash that temporarily wiped out nearly $1 trillion in market value.

Rogue trader

What has garnered the most attention is the authors' theory that a British trader, who has been indicted on charges of causing the flash crash, is most likely not responsible. The trader, Navinder Singh Sarao, is facing extradition to the United States after being arrested last April.

Aldrich said that since the paper became public more than a month ago he's been hearing from market analysts and technicians interested in the paper's assertions. It was also widely reported in the financial press.

He and coauthors continue to investigate. With seed funding from the Center for Analytical Finance at UC Santa Cruz, Aldrich and colleagues will further explore the impact of high-frequency trading with a simulated exchange that can replicate market conditions.

"We were really intrigued with last April's announcement that Sarao was being indicted," Aldrich said. "It caught everybody off guard. Could one guy really have done this?"

We have the data

Aldrich said he and Laughlin realized they had the data to analyze individual market trades leading up to the crash. Less than a year earlier, with UCSC physics undergraduate student Indra Heckenbach, they released a paper, "The Random Walk of High-Frequency Trading," that looked at high-frequency trading and the limits of time in terms of reporting trades.

After the April 2015 indictment of Sarao, Aldrich and his coauthors combed through court documents that U.S. prosecutors had filed and also took a close look at the trading data they had compiled for their earlier paper.

U.S. authorities have accused Sarao of "spoofing," manipulating the market by using an automated process to place a large number of sell orders, thus driving prices down, then cancelling them. He then could swoop in to buy securities at the artificially reduced prices and sell once they rose again. He's alleged to have profited $850,000 on the flash crash day.

Spoofing allegations spot on

"Allegations of spoofing are 100 percent correct," Aldrich says, but that's not what caused the flash crash. "Indeed, this paper suggests that the flash crash could have occurred even without Sarao's presence in the market," Aldrich and co-authors write.

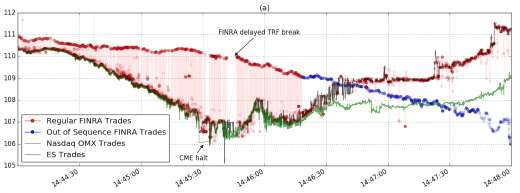

Instead they suggest that weakness in the trade-reporting infrastructure may have played a significant part. They use millisecond analysis both in terms of executed trades and, more importantly, in terms of data feeds as reporting of trades were being delayed by as much as 90 seconds.

The paper asserts that unsettled market conditions early in the day, combined with a huge sell order for the popular E-mini S&P 500 futures security by mutual fund manager Waddell & Reed helped trigger the sell-off. They point to and agree with a 2010 joint report by the Commodity Futures Trading Commission and the Securities and Exchange Commission that came to the same conclusion.

The authors say they are concerned that regulators will focus on spoofing activities as an effective substitute to avoid future flash crashes rather than a more fundamental restructuring of markets.

"Our work instead suggests that policymakers interested in reducing the probability of a future Flash Crash are better guided by the findings of the joint CFTC-SEC staff report, which does not rely on Sarao's presence in the market," the paper states.

More information: Eric M. Aldrich et al. A Compound Multifractal Model for High-Frequency Asset Returns, SSRN Electronic Journal (2014). DOI: 10.2139/ssrn.2481201

Provided by University of California - Santa Cruz