September 22, 2010 weblog

Former physicist investigates May 6 flash crash

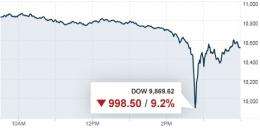

(PhysOrg.com) -- Ever since the "flash crash" of May 6, 2010, investors have been wondering exactly what happened that Friday afternoon. As stock markets were trending down due to concern about the debt crisis in Greece, the Dow Jones Industrial Average suddenly plunged 600 points in about 5 minutes. Then 20 minutes later, the Dow recovered most of the loss, and finished the day down more than 200 points.

Gregg Berman, a former particle physicist with 16 years of experience on Wall Street, is working for the Securities and Exchange Commission (S.E.C.) to lead a team of more than 20 investigators to find out what caused the flash crash. Over the past several months, the investigators have gathered and analyzed large amounts of data and interviewed hundreds of companies, and now plan to publish a report of their findings within the next two weeks. Although Berman isn't revealing details about the results, in an article in The New York Times he says that he found no evidence of a deliberate attempt to manipulate the markets. Instead, the investigators have identified a specific series of events that led up to the crash.

“The report will clearly demonstrate how market conditions and events prior to the flash crash led to the extreme price moves,” Berman said, adding that the overall picture may not be as simple and straightforward as many people would like.

In the weeks and months after the flash crash, a number of theories have been proposed to explain the volatile activity. One of the first theories was the “fat finger,” in which someone accidentally sold an extremely large order, triggering more selling. Another theory was that the European debt crisis had made the markets volatile, which caused some high-frequency automated trading programs to stop trading, which in turn caused confusion among other computerized programs. Regulators now consider both of these theories to be doubtful.

In contrast with these simpler explanations, Berman said that his explanation involves several factors occurring simultaneously. He explained that market participants were doing different things for different reasons, and that the varying “circuit breaker” policies of different exchanges caused a lack of coordination and confusion, all of which played a role in the crash.

The results of the report will likely be used by a group of advisers to the S.E.C. and the Commodity Futures Trading Commission to make policy recommendations. The results and subsequent policy changes may also reassure investors, who have withdrawn money from stock mutual funds every week since the flash crash.

More information: via: The New York Times

© 2010 PhysOrg.com