April 3, 2014 feature

Econophysics: Can antimoney prevent the next financial crisis?

(Phys.org) —Borrowing and lending money are essential interactions in a thriving economy, yet they come with their own set of risks. For instance, the credit money that is often involved in lending is thought to play a major role in causing large-scale financial crises, such as real estate collapses. As part of this balancing act, economists face the challenge of simultaneously maintaining both liquidity and stability (in the form of a constant money supply) to keep the economy moving along at a steady, controlled pace.

In an attempt to reach these goals, a team of researchers has turned to the field of "econophysics," in which theories originally developed for physics are applied to economics. Physicists Matthias Schmitt, Andreas Schacker, and Dieter Braun at LMU Munich have published a paper on their ideas, influenced by statistical mechanics, in a recent issue of the New Journal of Physics.

Two currencies

In their paper, the scientists propose that the traditional notion of credit be replaced by a new concept that involves two types of currencies: money and "antimoney." While money is cold, hard cash, antimoney is basically the same as debt. However, unlike money and debt (or matter and antimatter), money and antimoney do not cancel out (or annihilate). This is because antimoney is not simply negative money; money and antimoney units are never added or subtracted to each other. Instead, money and antimoney are entirely different currencies, as different as euros, pounds, yen, dollars, etc.

As different currencies, money and antimoney have a constantly changing exchange rate. The purpose of the exchange rate is to prevent the inflation—or devaluation of the money currency—that comes with loaning and borrowing money. It's well-known in economics that traditional credit causes inflation by increasing the money supply, at least on paper. The problem with credit-induced inflation, the researchers explain, is that it negatively influences all market participants, while credit holders profit from the inflation because they wind up paying back their loans in devalued currency.

This problematic effect of credit can in principle be alleviated by full-reserve banking, in which banks are required to keep the full amount of their depositors' funds in cash, i.e., the banks are prohibited from credit creation and the money supply remains constant. Unfortunately, full-reserve banking traditionally results in low liquidity or "credit crunches" and therefore slow economic growth.

In the money-antimoney economy, however, the researchers show that it's possible to implement full-reserve banking while providing sufficient liquidity. In this type of economy, market participants reap one of the most important benefits from full-reserve banking, which is a constant money supply. This benefit is due to the nature of a bicurrency system, the researchers explain.

"We find that, hiding in banking, you have an exchange rate between money and antimoney, i.e. that the creation of banking actually splits a given currency into two—but without allowing markets to judge the performance of the banks and judging the banks with this hidden but nowadays fixed exchange rate," Braun told Phys.org. "It was right in front of our eyes, but apparently was not seen.

"We also find that the these two currencies make it possible to do credit transactions without interest rates and without changing the quantity of money—and all this under a most dogmatic, neo-liberal, free market hypothesis. It is like finding an inherent contradiction right inside banking. And something we could not use before computers."

Paying loans forward

To analyze this new economic structure, the scientists used a physics method called random transfers. In the model, agents randomly exchange money and antimoney, much like particles exchange energy. The randomness reflects the fact that an economic environment and the future of investments are difficult to predict for the agents. The results of the model showed that the money-antimoney economy offers advantages such as high liquidity, broad wealth distribution, and stability.

As the researchers explain, the key difference between a traditional credit economy and the money-antimoney economy is the nature of the borrowing/lending process. In a credit economy, a borrower receives a loan in the form of money along with a promissory note showing that the borrower agrees to pay back the money at a specified time. In the money-antimoney economy, a borrower receives both money and antimoney with electronic date stamps, but no promissory note, from a lender. This system requires that the lender have sufficient antimoney, i.e., debt, as well as money, to give the borrower.

The interesting thing about this transaction is that the borrower never pays the lender back. There is no need to pay anything back, since the borrower received both money and antimoney (debt) from the lender. Instead, the borrower will give the antimoney along with money to someone else by a certain future date.

The specific ratio of money and antimoney in the original loan transaction depends on the exchange rate between the two currencies, which is determined in part by the borrower's standing and also takes the place of the interest rate that the borrower and lender traditionally agree upon. So instead of relying on interest rates to judge the future value of a loan, the money-antimoney exchange rate dynamically compares the values of the past (antimoney) with the values of the future (money). No other market participants are affected by this transaction other than the borrower and lender who are directly involved.

"A loan transaction is a differential bet on the future between two participants," Braun explained. "One will want to buy a house, resulting in him after buying it with more antimoney than money. This means he will lose if antimoney becomes more valuable, but win if money becomes more valuable. The other wants to sell a house and wants the money, making him to have more money and less antimoney. So he will lose in the exact opposite scenario. So we hope (but cannot yet 'prove'—but what can you prove in economics?) that this leads to a well-balanced equilibrium between both strategies. One part betting on future investments, the other betting on selling past investment. It is fully symmetric, and all trading is real-time as opposed to interest rates which cannot go below 0% and require long-term, not-real-time contracts which feed delays into the economy. For us, this sounds interesting enough to follow it up with studying it to check its stability in more real-world situations, starting with a game theory competition between algorithms."

As for implementing the bicurrency system, the researchers note that money and antimony are already used in banks, just not separated. Still, implementation will involve some challenges. Just as some individuals in a credit economy accumulate more debt than they should, in the money-antimoney economy there is still the problem of individuals who hoard large amounts of antimoney. To prevent this, the researchers propose, for example, that caps can be imposed on an individual's antimoney, just as credit caps are imposed on individuals today. If an individual goes bankrupt after borrowing a loan of money and antimoney, the lender would have to take the antimoney back and become responsible for passing it on to someone else. This is the equivalent of a write-off today.

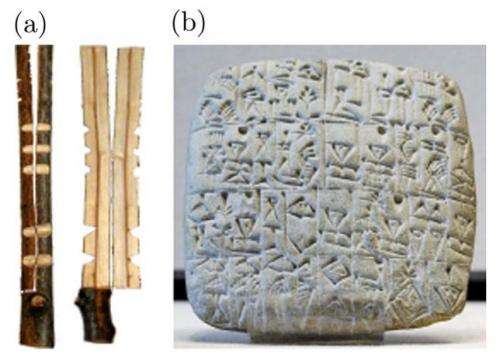

"One needs to keep track that no-one can destroy antimoney," Braun said. "There is a long-lasting history on this, starting with the clay tablets or the stock/stub pairs. Nowadays, cryptographic techniques will allow for this (similar to bitcoins—which, by the way, are completely missing that money is about debt contracts, not gold=computer-power backing). Such a cryptographic system needs to keep traders anonymous, but still keep track about the trades, such that if people choose to leave the system or die, the money and antimoney units are given back by the previous traders such that they are forced to add premiums into the exchange rates to ensure themselves against such odds. I think (and hope) that this cryptographic problem will be solvable. Anyhow, we will first need to see that the system behaves in a stable way under real-world investment markets."

More information: Matthias Schmitt, et al. "Statistical mechanics of a time-homogeneous system of money and antimoney." New Journal of Physics. DOI: 10.1088/1367-2630/16/3/033024

Journal information: New Journal of Physics

© 2014 Phys.org. All rights reserved.