May 3, 2012 feature

Statistical analysis could predict bankrupt stocks

(Phys.org) -- During the 20-year period from 1989 to 2008, 21% of of all stocks listed in US stock markets became bankrupt. Since bankruptcies affect many investors and have played a large role in the recent global financial crisis, predicting bankruptcy before it happens could help some investors avoid large losses. In a new study, a team of physicists has used concepts from statistical physics to identify some characteristic behaviors of pre-bankrupt stocks that differ significantly from stocks that don't become bankrupt. The approach may eventually help investors forecast stock bankruptcies weeks or months in advance.

The physicists, from Boston University in Boston, Massachusetts, and Fudan University in Shanghai, China, have published their study in a recent issue of EPL.

“On the basis of statistical analysis, we satisfactorily distinguish the evident difference between bankrupting and non-bankrupting stocks,” coauthor Jiping Huang of Fudan University told Phys.org. “This shows that it is possible to develop a statistical-analysis-based early warning system to forecast the time of bankruptcy. The system depends on stock prices, rather than corporate internal financial information.”

For many decades, researchers and analysts have attempted to develop models for predicting corporate bankruptcy, but most of these models depend on the availability of detailed internal financial information about the corporation, which is often difficult to obtain. Here, the scientists have attempted to predict a corporation's risk of bankruptcy by observing the market dynamics of its stock price.

To do this, they analyzed the daily closing share prices and trading volume of all 20,092 stocks listed in US stock markets from January 1, 1989 to December 31, 2008. When defining stock bankruptcy as a stock with more than 100 days of trading records whose price drops more than 20% during the previous 100 trading days, 4,223 (21%) of all stocks became bankrupt during that period. (Somewhat surprisingly, nearly two-thirds [13,249] of all stocks disappeared from the market during this period due to delisting and mergers and acquisitions, in addition to bankruptcy.)

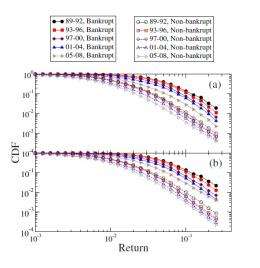

The new statistical physics analysis uncovered several ways in which the behavior of stocks approaching bankruptcy differs from that of non-bankrupting stocks. One of the biggest differences is in the distribution of returns: pre-bankrupt stocks are more likely to have larger daily returns (both positive and negative) than stocks that don't become bankrupt. In other words, pre-bankrupt stocks have larger day-to-day price fluctuations. As would be expected, the difference is bigger for negative returns than positive returns, indicating the falling stock price preceding a bankruptcy. The closer the day of bankruptcy approaches, the greater the possibility for these dramatic price changes.

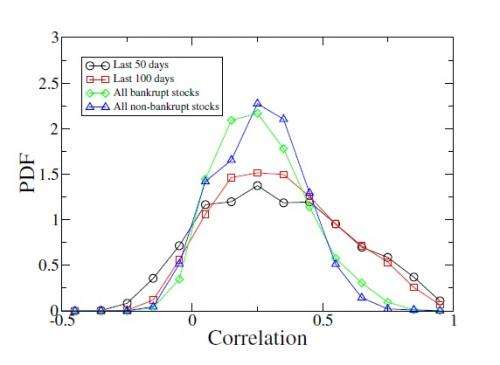

A second major difference between pre-bankrupt stocks and others is that the former experience a stronger correlation between volatility and volume. Previous research has shown that volatility and volume exhibit a positive correlation, meaning that large changes in stock price are often accompanied by large changes in trading volume. But during the 100 days preceding bankruptcy, a stock's volatility and volume both tend to increase more than usual, and so the two become more strongly correlated than normal. So even without knowing the underlying causes of the increased volatility and volume, the strong correlation provides a statistical indication of approaching bankruptcy.

The analysis uncovered another trend in the overall stock market during this 20-year period. When plotting the distribution of daily returns, the researchers grouped the results into four-year periods. During each four-year period, for both pre-bankrupt and non-pre-bankrupt stocks, the probability of having large returns decreased as time passed. This finding suggests that the entire stock market became progressively more mature and stable during this period.

In the future, the physicists plan to further investigate these characteristic behaviors of stocks about to become bankrupt. They hope to develop a model that can precisely predict the time of bankruptcy, since the changes in stock behavior tend to increase closer to the day of bankruptcy. They also hope to gain insight into the underlying causes of the pre-bankrupt behavior identified here.

“In principle, [this pre-bankrupt stock behavior] can be understood on the basis of human behavior in stock markets,” Huang said. “Due to the characteristic of self-interest, facing a 'good' stock or a 'bad' stock, the attitude of an investor is quite different, thus yielding distinct investing behavior. More details on the mechanism can only be revealed by comparing the present results with those obtained from agent-based modeling. This is a future project.”

More information: Qian Li, et al. "Statistical analysis of bankrupting and non-bankrupting stocks." EPL, 98 (2012) 28005. DOI: 10.1209/0295-5075/98/28005

Copyright 2012 Phys.Org

All rights reserved. This material may not be published, broadcast, rewritten or redistributed in whole or part without the express written permission of PhysOrg.com.