This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Researcher investigates fraud deterrence in under-examined markets

Asper School of Business assistant professor of finance Jianning Huang has published a paper in Review of Accounting Studies, co-authored with Richard A. Cazier and Fuzhao Zhou, that examines how regulation affects the prevalence of fraud in over-the-counter (OTC) stock markets.

While most stocks are traded through major stock exchanges like the Nasdaq or New York Stock Exchange, OTC firms are not listed on these exchanges. Despite existing outside of major stock exchanges, the OTC market is vast, with daily dollar volume of $1.5 billion as of 7 November 2023.

Huang explains why these substantial OTC markets can be particularly susceptible to fraud.

The stock prices of many OTC firms also fluctuate more dramatically than exchange-traded stocks. Combined, the susceptibility of OTC stocks to large price swings and the low level of firm disclosure can make OTC firms ripe for fraud and pose additional challenges to regulators, researchers and retail investors.

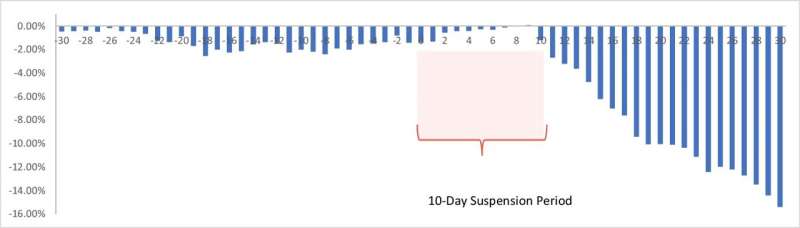

In their paper, Huang and co-authors assess the impact of Operation Shell-Expel, an initiative launched by the Securities and Exchange Commission (SEC) in 2012 to reduce OTC market fraud. The initiative targeted companies that appeared dormant, proactively suspending their operations until they could prove their legitimacy.

Despite others' criticism of Operation Shell-Expel and doubts about its efficacy, Huang and co-authors hypothesized that the initiative does successfully reduce fraud overall.

"First, we looked at the impact on firms that were suspended," he explains. "We then looked at other firms with headquarters in the same state as the suspended firms. We found that when suspect firms were proactively suspended, fraud decreased overall at the state level."

In other words, regulation of one firm "spills over" to reduce fraud among firms in the same state.

Huang's research attends to a growing population of retail investors—who are entering the markets earlier and engaging more than ever. Through his work, he contributes to a better market environment, one that allows individual investors to make informed investments in the OTC market and allows policymakers to strike a balance between deterring fraud and fostering growth.

More information: Richard A. Cazier et al, Regulatory spillover effects in OTC markets, Review of Accounting Studies (2023). DOI: 10.1007/s11142-023-09802-8

Provided by University of Manitoba