This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Why analysts make mistakes that take stock markets on a roller coaster ride

The extent of fluctuations on Wall Street has always surprised those who apply basic asset pricing models to the market. These models explain stock prices based on the return required by investors to hold assets with different levels of risk.

Therefore, stock prices should be firmly anchored to the oscillations of the fundamentals that determine shareholder remuneration (dividends and profits). When the ups and downs of listed stocks become more pronounced than those of the fundamentals, asset pricing models appeal to unobservable changes in investors' risk appetite: if prices drop, it's because risk appetite has decreased, and vice versa.

Nicola Gennaioli, the Romeo and Enrica Invernizzi Foundation Chair in Behavioral Economics and Finance, proposes a radically different explanation based on the principles of cognitive economics and supported by the real observation of long-term expectations of traders.

In a study with Pedro Bordalo, Rafael La Porta, and Andrei Shleifer, Professor Gennaioli uses the reports of thousands of analysts who since the 1980s have been releasing their forecasts about the profits and dividends of listed companies. These forecasts are a concrete and observable measure of market expectations, and the authors have found that they are much more volatile than the actual changes in fundamentals. The work is published in the Journal of Political Economy.

"If we replace the realized values of fundamentals in asset pricing models with those expected by the market," Prof. Gennaioli explained, "we no longer observe any excess variability in price fluctuations. These values explain price fluctuations well, without resorting to unverifiable assumptions about changes in risk appetite."

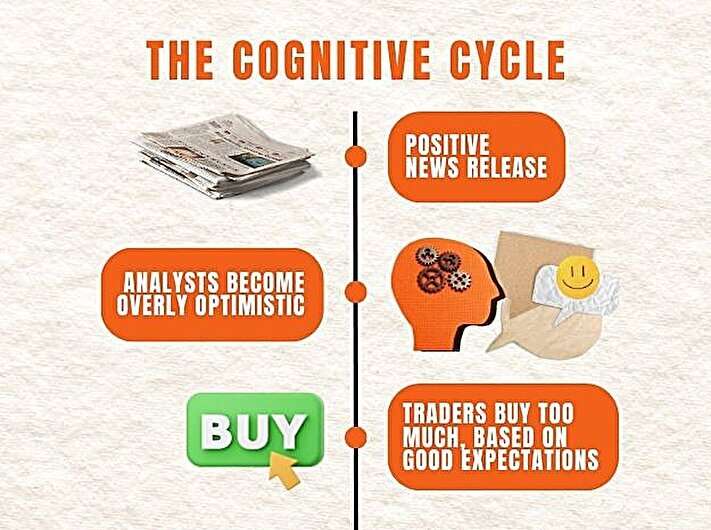

The study provides a behavioral explanation for the oscillation of expectations, specifically the overreaction to the most recent news on profits and dividends. "Analysts become overly optimistic when positive news is announced and overly pessimistic when news is negative," Prof. Gennaioli further explained.

"In the first case, stock prices will rise too much, and when news that the actual results fell below expectations spreads, expectations become overly pessimistic. Then, stock prices drop excessively, leading to cycles with fluctuations that are wider than the variations of the fundamentals."

The scholars demonstrate that this psychological mechanism can explain not only the fluctuations of the overall American market but also the different fluctuations of stocks of different companies. Finally, they clarify that the truly explanatory variable is long-term rather than short-term expectations.

More information: Pedro Bordalo et al, Belief Overreaction and Stock Market Puzzles, Journal of Political Economy (2023). DOI: 10.1086/727713

Provided by Bocconi University